Earnings reports. Let’s be honest, they can feel like a financial snooze-fest. But, and this is a big but , when a giant like Micron Technology dishes out its quarterly numbers, it sends ripples far beyond Wall Street. We’re not just talking about stock prices here; we’re talking about a peek into the future of everything from your smartphone to AI data centers. So, grab your coffee, and let’s dive into why Micron’s earnings report is worth your attention.

The Memory Market | A Canary in the Coal Mine?

Here’s the thing: Micron isn’t just a company; it’s a bellwether. Think of them as a canary in the coal mine for the entire tech industry. They’re one of the world’s leading manufacturers of memory chips – DRAM and NAND flash – which are essential components in, well, pretty much everything these days. And because memory demand is so closely tied to overall tech spending, Micron’s performance can offer early warnings about the health of the broader economy. A common mistake I see people make is dismissing memory as just one component, failing to recognize its pivotal role across so many sectors.

So, what do their latest numbers tell us? Are we looking at clear skies or a potential storm brewing? According to Wikipedia , the memory market is subject to cyclical changes. Let’s find out if we’re currently climbing a hill, or bracing for a plunge.

Beyond the Numbers | What’s the Real Story?

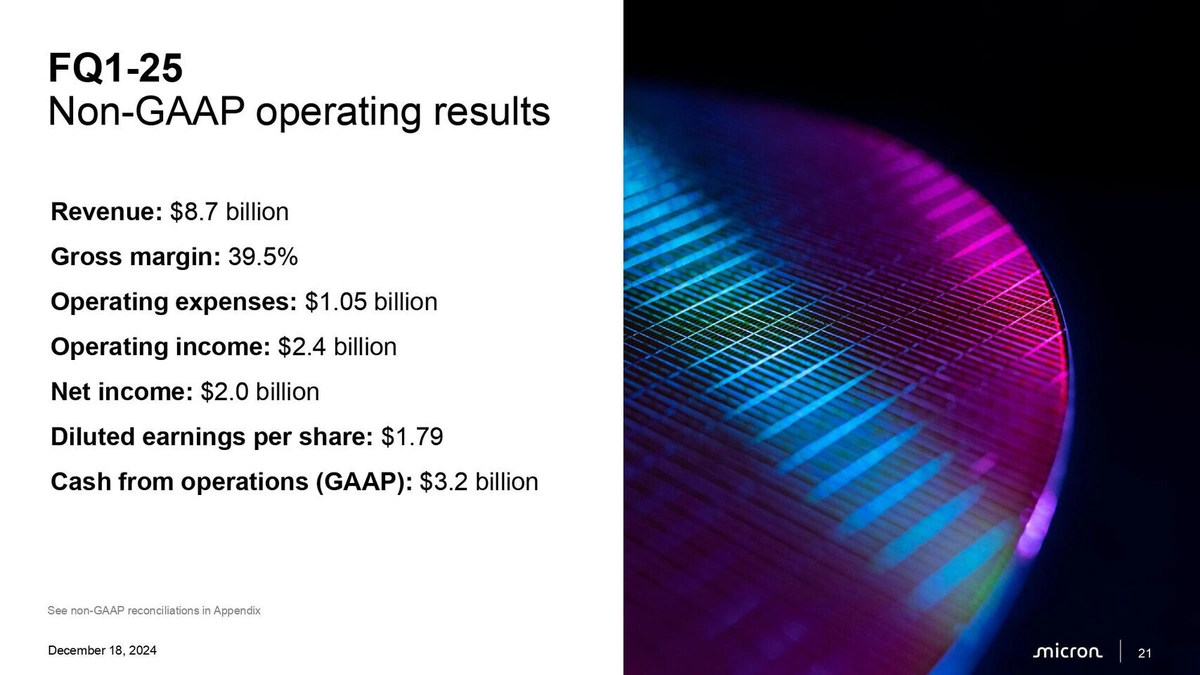

Don’t get bogged down in just the revenue and EPS figures. Those are important, sure, but the real gold lies in what the management team says during the earnings call. What are they saying about demand trends? Are they seeing any shifts in pricing? How are they managing their inventory levels?

Let me rephrase that for clarity: the guidance they provide for the next quarter – and even the next year – is crucial. Are they projecting growth, stability, or a slowdown? This forward-looking commentary can give you a major advantage in understanding where the tech industry is headed. Consider, too, where this information fits with respect to insights about Marcus Lemonis , because what we need is the full picture.

AI, Data Centers, and the Micron Advantage

The rise of artificial intelligence (AI) is a game-changer for the memory industry – and, by extension, for Micron. AI applications require massive amounts of memory to process data, and that’s creating huge demand for high-bandwidth memory (HBM) and other advanced memory solutions. What fascinates me is how Micron is positioning itself to capitalize on this trend.

Are they investing enough in HBM production? Are they forging partnerships with leading AI chip designers? These are the kinds of questions you should be asking to assess Micron’s long-term prospects. And it’s not just AI; the explosion of data centers is also driving demand for memory. As more and more businesses move their operations to the cloud, they need faster and more efficient storage solutions. Micron’s NAND flash memory is a key enabler of these data centers, making them another critical growth driver.

The Geopolitical Angle | Trade Wars and Supply Chains

We can’t ignore the elephant in the room: geopolitics. The ongoing trade tensions between the U.S. and China, as well as other global events, can have a significant impact on Micron’s business. Why? Because the company has a complex supply chain that spans multiple countries.

Tariffs, export restrictions, and other trade barriers can disrupt this supply chain, leading to higher costs and lower profitability. It’s important to monitor these developments closely to understand the potential risks to Micron’s financial performance . Also, keep an eye on how Micron is adapting to these challenges. Are they diversifying their supply chain? Are they lobbying for more favorable trade policies? Their responses to these issues will be critical to their long-term success. According to the United States Trade Representative’s official website (ustr.gov) , trade policy is continually evolving.

Final Thoughts | Think Beyond the Headlines

So, the next time you see a headline about Micron’s earnings report , don’t just skim it and move on. Dig deeper. Understand the underlying trends that are shaping the company’s performance and, more importantly, the tech industry as a whole. Micron’s earnings are a window into the future – a future that’s being shaped by AI, data centers, and geopolitical forces. Pay attention, and you might just get a glimpse of what’s to come. In considering what is to come, recall that stock analysis always contains a degree of risk.

FAQ About Micron Technology Earnings

What does a positive micron technology earnings report usually indicate?

Generally, it suggests strong demand for memory chips and potentially positive trends in the broader tech industry.

How do stock market analysts typically react to surprising data in the report?

Unexpectedly high earnings often lead to stock price increases, while disappointing figures can trigger declines.

What if I’m new to investing; where can I find reliable financial news about Micron?

Reputable sources like Bloomberg, Reuters, and The Wall Street Journal are good starting points.

What are the major factors driving Micron’s stock price?

Memory prices, demand from key sectors (like AI and data centers), and overall economic conditions are key drivers.

What exactly is DRAM technology and why is it important?

DRAM (Dynamic Random-Access Memory) is a type of volatile memory used in computers and other devices. It’s crucial for fast data processing.

How does NAND flash memory play a role in Micron’s profitability?

NAND flash is used in storage devices like SSDs and smartphones. Strong demand for these products boosts Micron’s NAND sales and profitability. Additionally, consider information about ZS Stock to provide full context.