Alright, let’s dive into this currency swap deal between the US and Argentina. You might be thinking, “Okay, cool, another financial agreement.” But here’s the thing: this one’s got layers, like a perfectly made biryani. It’s not just about exchanging currencies; it’s about navigating tricky economic waters, especially for Argentina. Let’s be honest, economic stability can feel like a distant dream in Argentina. A $20 billion currency swap deal can feel like a life raft.

The ‘Why’: Unpacking the Significance of This Currency Swap

So, why is this deal such a big deal? It’s all about stability and access to foreign exchange reserves . Argentina has been facing a severe shortage of US dollars, which are crucial for international trade and debt repayment. Think of it like this: if Argentina wants to buy essential goods from abroad or pay back loans, they need dollars. Without enough dollars, things get difficult – inflation rises, businesses struggle, and people feel the pinch. This bilateral agreement with the US gives Argentina a cushion, allowing them to access dollars without depleting their already strained reserves. And while it’s a sigh of relief, it also shows Argentina’s reliance on international support.

But, there’s a subtle game at play too. Argentina, like many emerging economies, often deals with fluctuations in their own currency value. A currency swap allows them to temporarily ‘borrow’ a stronger currency (in this case, US dollars) and use it to stabilize their own, the Argentine Peso. This isn’t a permanent fix, mind you; it’s more like a temporary dam against a flood.

Digging Deeper: How a Currency Swap Works

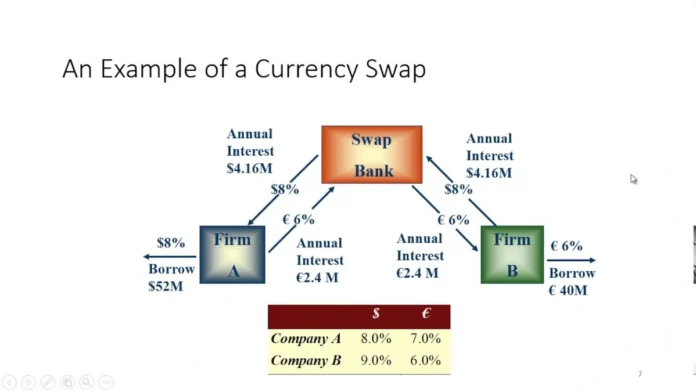

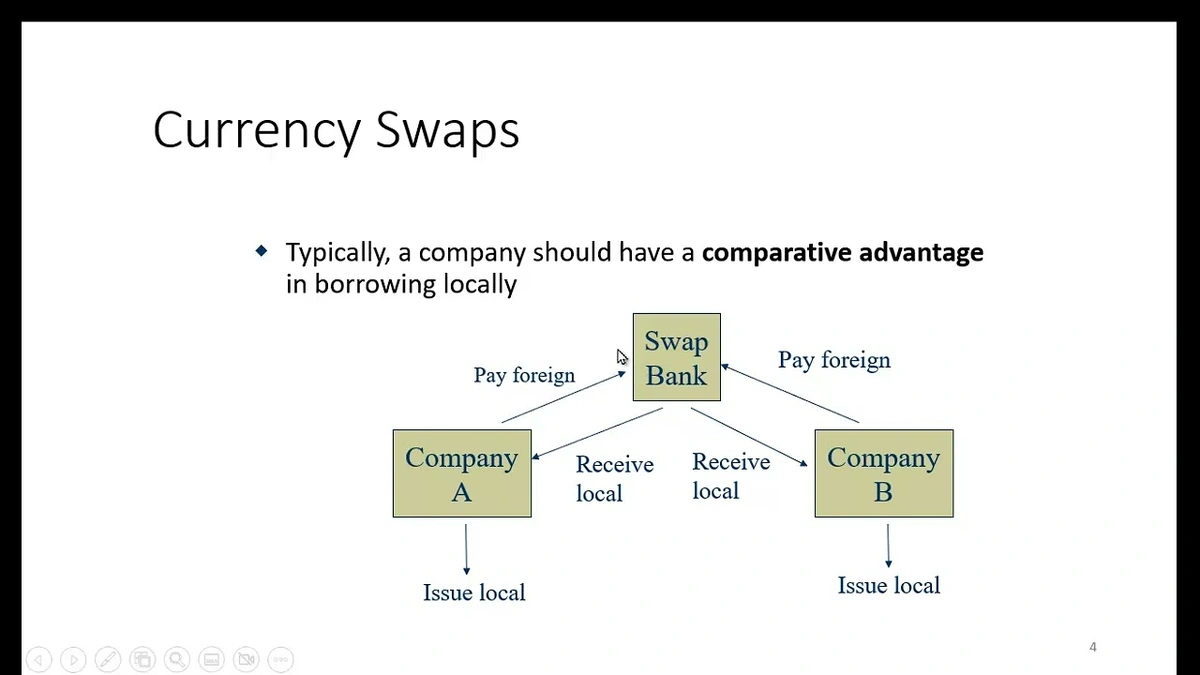

Let me rephrase that for clarity: A currency swap agreement isn’t just about handing over cash. It’s a bit like a loan, but with currencies instead of money. Argentina gets US dollars from the US, and in exchange, the US gets an equivalent amount of Argentine Pesos, based on an agreed-upon exchange rate. Crucially, there’s an agreement to reverse the transaction at a future date, usually with some interest or fee involved. It’s essentially a repurchase agreement for currencies. What fascinates me is the trust element – both countries need to believe the other will hold up their end of the deal.

Think of it like this: imagine you’re borrowing sugar from your neighbor because you ran out while baking a cake. You promise to give them back the same amount of sugar later, maybe with a little extra as a thank you. This international financial transaction is similar, but on a much larger scale. The ‘sugar’ is US dollars, and the ‘thank you’ is the interest or fee.

The Impact on Argentina | Beyond the Headlines

Now, let’s talk about the real impact of this deal on Argentina. It’s not just about easing the immediate pressure on their foreign exchange market . It can also have a ripple effect on the broader economy. A more stable currency can help businesses plan for the future, reduce inflationary pressures , and attract foreign investment. And , this is a big “if,” it depends on how Argentina uses these dollars. If they use them wisely, to boost productivity and strengthen their economy, the swap could be a game-changer. But if they simply use them to kick the can down the road, the underlying problems will remain. A common mistake I see countries make is not tackling the root causes of economic instability. It can be tempting to rely on short-term fixes, but long-term solutions are key.

The one thing you absolutely must remember is that this financial stability is not a magic bullet. It’s a tool, and like any tool, it needs to be used effectively. The Argentine government needs to implement sound economic policies, address structural issues, and build investor confidence. A currency swap is not a substitute for these fundamental reforms.

Potential Downsides and Risks

But, everything isn’t perfect and there are potential downsides too. Argentina will eventually have to repay the US dollars, and if their economy doesn’t improve, this could create further problems down the line. A key indicator is whether this short-term financial relief will provide enough time for Argentina to implement necessary reforms, or if it will only delay inevitable crises.

Let me rephrase that: What if Argentina’s economy doesn’t turn around? What if they’re unable to repay the dollars when the swap agreement expires? This could lead to further economic instability, and potentially even a default. That’s the risk they’re taking. But, sometimes, you have to take risks to survive.

Currency Swap | A Global Perspective

Currency swaps are not unique to the US and Argentina. They are a common tool used by central banks around the world to manage exchange rates, provide liquidity, and stabilize their economies. The European Central Bank, for example, has used currency swaps extensively to help member countries during times of crisis. According to Wikipedia , it is used worldwide. But, the effectiveness of a currency swap depends on the specific circumstances of each country. What works for one country may not work for another. The fundamental factors are the underlying economic policies and the political stability of the country.

I initially thought this was a straightforward agreement, but then I realized how much it reflects the complex global economy and the challenges faced by emerging markets. These deals can be very beneficial. But if not handled well, they can also backfire. Also keep in mind the stock market could be affected.

FAQ About Currency Swap

What exactly is a currency swap?

It’s an agreement between two parties to exchange currencies for a specified period, and then reverse the transaction at a later date.

Why do countries use currency swaps?

To manage exchange rates, provide liquidity in foreign currencies, and stabilize their economies.

What are the risks associated with currency swaps?

If the borrowing country’s economy doesn’t improve, they may struggle to repay the borrowed currency.

Is this deal a long-term solution for Argentina’s economic problems?

No, it’s a temporary measure. Argentina needs to implement sound economic policies for a lasting solution. Also, a strong foreign exchange rate is needed.

How does this agreement impact global trade?

It can facilitate trade by providing Argentina with access to US dollars for international transactions.

What is a Bilateral Swap Agreement?

It’s a currency swap agreement between two countries. These Bilateral Swap Agreement helps with balance of payments, monetary policy, and financial crisis prevention.

So, there you have it. The US and Argentina’s currency swap deal is more than just a financial transaction; it’s a reflection of global economic realities, the challenges faced by emerging markets, and the ongoing quest for stability in an uncertain world. Ultimately, the success of this deal will depend on Argentina’s ability to use this opportunity to build a stronger, more resilient economy. It’s not just about the dollars; it’s about what they do with them.