Alright, folks, let’s dive into something fascinating happening in the world of phosphates – yes, you heard me right, phosphates! First Phosphate, a name you might not be super familiar with yet, is making waves with its North American LFP (Lithium Iron Phosphate) strategy. And guess what? Their shares are surging. Now, why should you, sitting perhaps with a cup of chai in hand, care about this? Let’s break it down, shall we?

Why LFP Matters to You (Even if You’re Not a Battery Expert)

Here’s the thing: LFP batteries are becoming increasingly important. We’re talking about the kind of batteries that power electric vehicles (EVs), energy storage systems, and even some of your everyday gadgets. But why LFP over other types of lithium-ion batteries? Well, they’re generally safer, more stable, and have a longer lifespan. Plus, they often use more ethically sourced materials – a big win in a world increasingly concerned about sustainability.

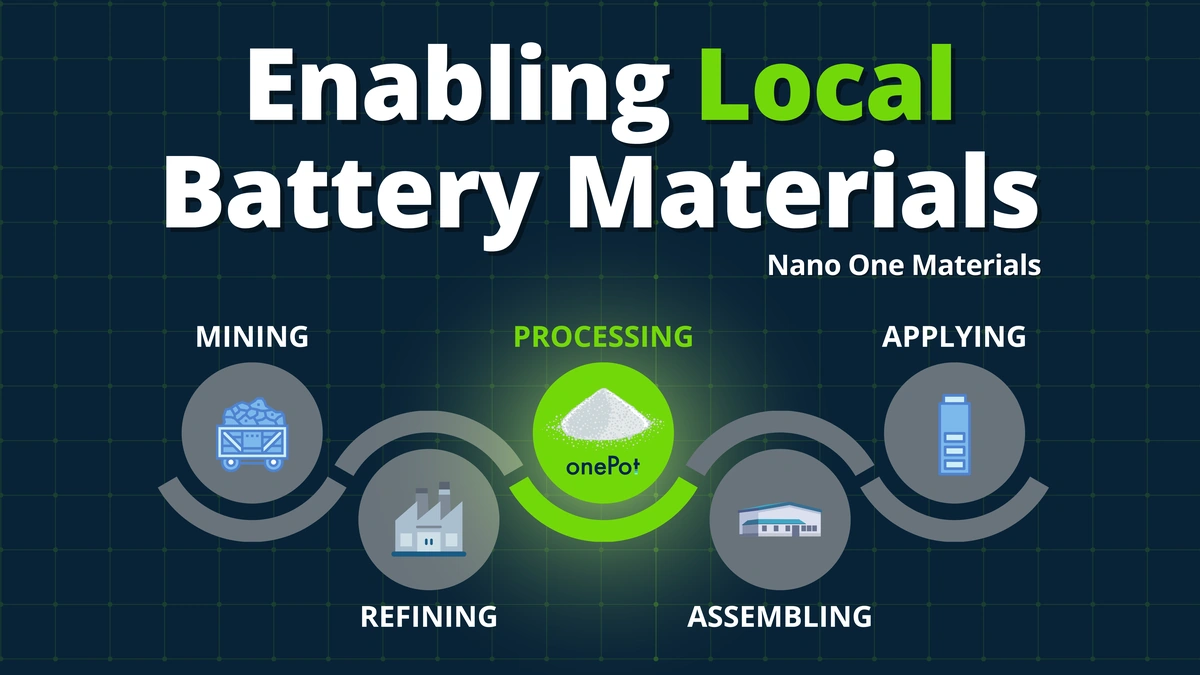

First Phosphate’s focus on North America is crucial. It’s not just about digging up some phosphate rock and calling it a day. It’s about creating a secure and reliable supply chain within North America. This reduces reliance on overseas sources, which can be subject to geopolitical risks, trade wars, and all sorts of other headaches. Think of it as bringing essential manufacturing closer to home.

And this is where supply chain resilience comes into play. In today’s globalized world, having control over your supply chain is like holding the master key. If First Phosphate can establish a strong foothold in the North American LFP market, it not only benefits the company but also strengthens the region’s ability to produce batteries and other critical components. A common mistake I see people make is underestimating the importance of a robust supply chain; it’s the backbone of any successful manufacturing industry.

How First Phosphate’s Strategy Impacts the EV Revolution

So, how does all this relate to the electric vehicle revolution happening worldwide, including right here in India? Simple. As EVs become more mainstream, the demand for LFP batteries will skyrocket. Electric vehicle adoption is no longer a distant dream; it’s a rapidly approaching reality. And to meet that demand, we need companies like First Phosphate to step up and provide the raw materials and processed phosphates needed to make those batteries.

Consider this: India is aggressively pushing for EV adoption, with ambitious targets for electric vehicle sales in the coming years. But to achieve those targets, India needs access to a reliable supply of batteries and battery components. While India is working hard to develop its own domestic battery manufacturing capabilities, partnerships and collaborations with companies like First Phosphate could play a crucial role in securing that supply.

The surge in First Phosphate’s shares is a signal. It’s a signal that investors believe in the company’s strategy and its potential to capitalize on the growing demand for LFP batteries. It’s also a signal that the market recognizes the importance of a secure and reliable North American phosphate supply chain . But,

First Phosphate has the potential to reshape the landscape of the LFP market in North America and beyond.

Digging Deeper | The Long-Term Implications

But let’s zoom out and look at the bigger picture. What are the long-term implications of First Phosphate’s North American LFP strategy? Well, for starters, it could lead to the creation of new jobs and economic opportunities in the region. From mining and processing to manufacturing and research, the LFP battery supply chain has the potential to generate significant economic activity. This helps in growing the North American economy .

Moreover, a strong North American LFP industry could help to reduce the environmental impact of battery production. By sourcing materials more locally and implementing sustainable manufacturing practices, companies like First Phosphate can minimize their carbon footprint and contribute to a cleaner, greener future.

According to Wikipedia , the chemical formula of lithium iron phosphate is LiFePO4. As per the guidelines mentioned in the information bulletin, LFP can achieve high levels of safety. I initially thought this was straightforward, but then I realized the significance of LFP for India.

What fascinates me is the potential for collaboration between North American and Indian companies in the LFP battery space. Imagine a scenario where First Phosphate supplies sustainably sourced phosphate materials to Indian battery manufacturers, helping them to produce high-quality, affordable LFP batteries for the Indian market. That could be a win-win situation for both regions.

FAQ About First Phosphate and LFP Batteries

FAQ

What exactly is LFP?

LFP stands for Lithium Iron Phosphate. It’s a type of lithium-ion battery known for its safety, stability, and long lifespan.

Why is First Phosphate focusing on North America?

To establish a secure and reliable supply chain within North America, reducing reliance on overseas sources.

How does this affect electric vehicles in India?

A reliable LFP supply chain can support India’s growing demand for EV batteries, helping the country achieve its EV adoption targets.

Is LFP environmentally friendly?

LFP batteries often use more ethically sourced materials, and local production can reduce the carbon footprint of battery manufacturing.

Can India benefit from First Phosphate’s strategy?

Yes, through potential partnerships and collaborations to secure a supply of high-quality LFP battery materials.

I have noticed an increase in the growth of LFP technologies.

What are some key challenges for First Phosphate?

Scaling up production, securing financing, and navigating regulatory hurdles are key challenges.

So, there you have it. First Phosphate’s North American LFP strategy isn’t just about digging up rocks; it’s about building a more secure, sustainable, and economically vibrant future for the battery industry. And that, my friends, is something worth paying attention to. The one thing you absolutely must double-check on is the potential impact of phosphate mining on local communities.