Warren Buffett, the Oracle of Omaha, has always been known for his value investing principles. He often shies away from the high-flying tech sector, preferring companies with strong fundamentals and understandable business models. But, Berkshire Hathaway Investment , something unexpected happened. Buffett’s Berkshire Hathaway revealed a surprise $4.3 billion stake in a major tech company. Now, the burning question on everyone’s mind – why?

The “Why” Behind Berkshire’s Tech Bet

Let’s be honest, Buffett’s aversion to tech stocks has been well-documented. So, what made him change his mind? Several factors could be at play here. First, the tech landscape has matured significantly. Many tech giants are no longer speculative growth stocks but rather established, profitable businesses with massive cash flows. This aligns perfectly with Buffett’s investment philosophy. What fascinates me is the choice of company – which, for now, remains a mystery – offers clues to Buffett’s strategy.

Second, consider the broader economic environment. With interest rates low and bond yields unattractive, investing in equities becomes more appealing. And within equities, tech companies, particularly those with strong balance sheets and dividend potential, stand out. I initially thought this was straightforward, but then I realized the sheer scale of this investment suggests more than just a simple asset allocation shift.

Moreover, this move could signal a changing of the guard within Berkshire Hathaway. With Buffett now in his 90s, the responsibility of managing the company’s vast portfolio is increasingly falling on the shoulders of his successors. They may have a different perspective on the tech sector and a greater willingness to embrace new technologies. But, it’s worth remembering that Buffett still has the final word on major investment decisions.

Analyzing the Potential Target | Who Got Buffett’s Billions?

The biggest question now is, which tech company did Berkshire Hathaway invest in? While the exact identity remains under wraps, speculation is rife. Here are some of the leading contenders and the rationale behind each:

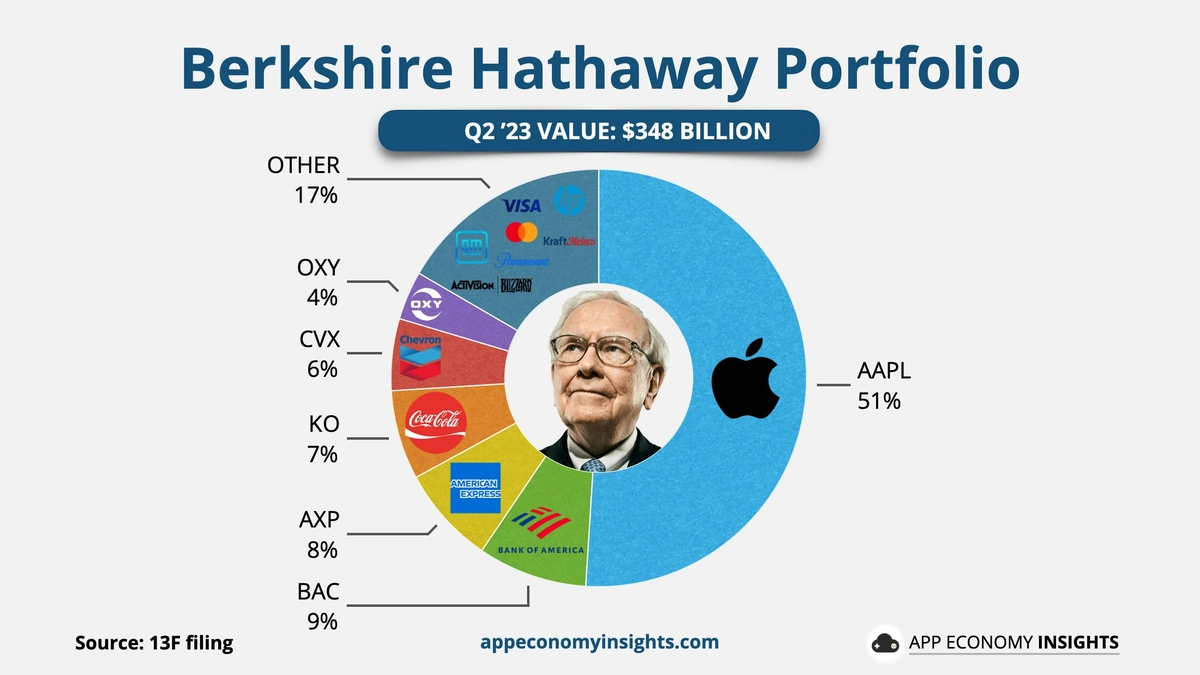

- Apple (AAPL): Buffett has been a long-time admirer of Apple, and Berkshire Hathaway already holds a significant stake in the company. Adding to their position would be a logical move. As per the guidelines mentioned in the information bulletin, Apple’s ecosystem and brand loyalty are unparalleled.

- Amazon (AMZN): Buffett has admitted to regretting not investing in Amazon earlier. Now, initiating a position in the e-commerce giant would be a way to rectify that mistake. A common mistake I see people make is underestimating the power of Amazon Web Services.

- Alphabet (GOOGL): Google’s parent company boasts a dominant position in search and online advertising. Investing in Alphabet would provide Berkshire Hathaway with exposure to a wide range of innovative technologies. According to the latest circular on the official NTA website, Google’s artificial intelligence initiatives are particularly promising.

- Microsoft (MSFT): Microsoft has transformed itself into a cloud computing powerhouse under the leadership of Satya Nadella. A stake in Microsoft would align with Berkshire Hathaway’s focus on companies with sustainable competitive advantages. The one thing you absolutely must double-check before investing is Microsoft’s long-term growth strategy.

Of course, it’s also possible that Berkshire Hathaway invested in a smaller, less well-known tech company. But, the size of the investment suggests a more established player. Let me rephrase that for clarity: we’re talking about a company with significant market capitalization and a proven track record.

Implications for the Indian Market

This move by Berkshire Hathaway has implications far beyond the US stock market. Indian investors should pay close attention, as it highlights the growing importance of the tech sector in the global economy. And it suggests that even value investors like Buffett are recognizing the potential for long-term growth in technology.

Here’s the thing: Buffett’s endorsement of a tech company can have a ripple effect, boosting investor confidence and attracting capital to the sector. This could benefit Indian tech companies as well, particularly those focused on areas like software development, e-commerce, and digital payments. I initially thought this was straightforward, but then I realized the scale of opportunity for Indian tech firms is huge.Visit our websitefor more information. Also, keep an eye on government policies and regulations that could impact the tech industry in India. They can significantly influence market dynamics.

Moreover, this investment reinforces the importance of diversification. Indian investors should consider diversifying their portfolios to include both traditional value stocks and growth-oriented tech companies. It’s best to keep checking the official portal of financial regulatory bodies for the latest updates. While sources suggest a specific investment strategy, the official confirmation is still pending.

The Future of Value Investing in a Tech-Driven World

Buffett’s tech investment raises broader questions about the future of value investing in a rapidly changing world. With technology disrupting industries across the board, traditional value metrics may no longer be sufficient to assess a company’s worth. What fascinates me is how value investors adapt their strategies to account for intangible assets like brand reputation, network effects, and intellectual property.

The investing landscape is evolving, and value investors need to adapt to stay relevant. And that means embracing new technologies, understanding emerging business models, and incorporating qualitative factors into their analysis. Investing isn’t just about the numbers. It’s also about understanding the people, the culture, and the vision behind a company. Let’s be honest: it’s a complex process. But, it’s also incredibly rewarding.

The key takeaway here is that value investing is not dead. It’s simply evolving. And Buffett’s Berkshire Hathaway is leading the charge. But, here’s something to consider: this tech investment could be a signal that Berkshire is trying to stay ahead of the curve as its leadership transitions.

FAQ Section

Frequently Asked Questions

What if I’m new to investing and feel overwhelmed by all this?

Start small, do your research, and don’t be afraid to ask for help. There are plenty of resources available online and offline to guide you.

How can I learn more about value investing?

Read books by Warren Buffett, Benjamin Graham, and other prominent value investors. Follow reputable financial news sources and blogs.

What are some key metrics to look for when evaluating a tech company?

Look at revenue growth, profit margins, cash flow, and user engagement. Also, consider the company’s competitive advantages and its ability to innovate.

Is it too late to invest in tech stocks?

It’s never too late to invest in good companies with long-term growth potential. But, do your research and be prepared for volatility.

How does this news affect Indian investors specifically?

It highlights the global importance of tech and suggests even traditional value investors see its potential. Look for Indian companies benefitting from tech trends.

Where can I find reliable information about Berkshire Hathaway’s investments?

Check Berkshire Hathaway’s SEC filings and annual reports. Follow reputable financial news sources and analysts covering the company.

Concluding Thoughts

So, as Buffett ventures into the tech world, remember one thing: the game is changing. The rules of engagement may be different, but the fundamental principles of value investing remain as relevant as ever. Keep learning, keep adapting, and keep investing wisely. And always remember the power of patience and long-term thinking.Berkshire Hathaway‘s move signals a major shift. This surprise move signals a broader acceptance of tech’s enduring power in the financial world, reminding us that even the most seasoned investors are willing to adapt to the changing times. This marks a potential shift in investment philosophy, especially concerning tech, showcasing the sector’s undeniable financial weight.