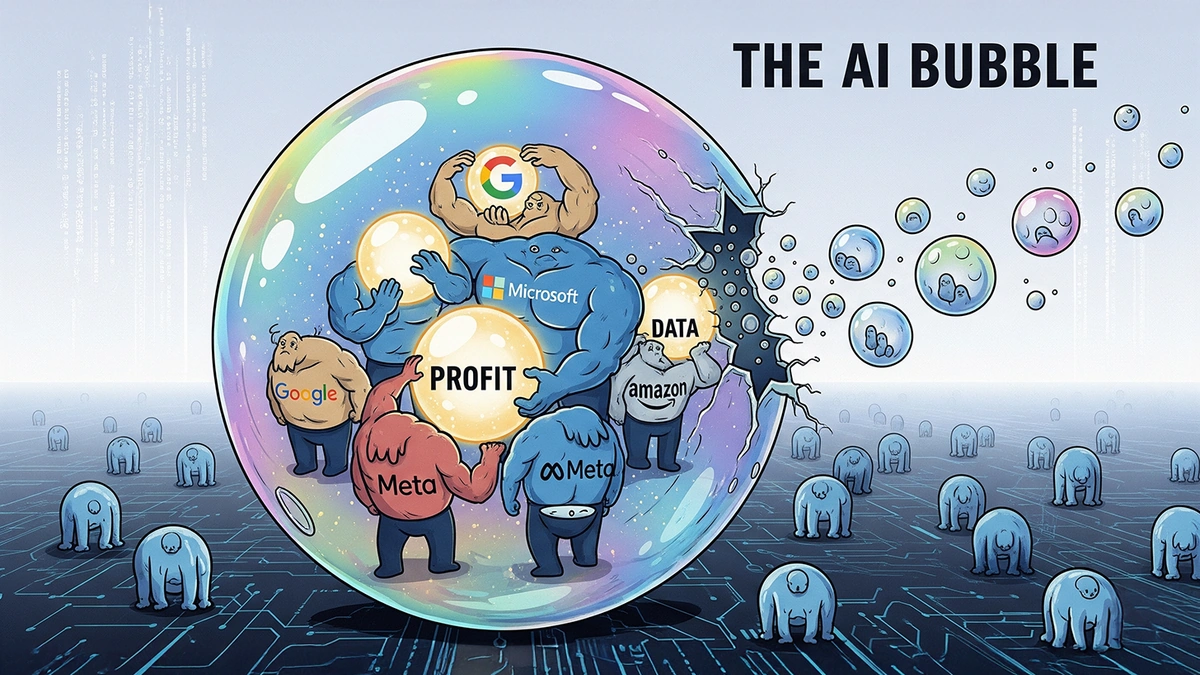

Okay, let’s be honest. The buzz around Artificial Intelligence (AI) is deafening. From self-driving cars to AI writing blog posts (ahem!), it feels like we’re on the cusp of a new era. But here’s the thing: whispers are starting to emerge from the hallowed halls of financial institutions – whispers of caution, of unease, of a potential AI bubble . Is it just healthy skepticism, or are we inflating something that’s about to pop? That’s the question we’re going to wrestle with today.

The “Why” | Decoding the Financial Jitters

So, why are these financial powerhouses suddenly getting cold feet? It’s not like they’re Luddites afraid of new technology. What fascinates me is that their concern stems from a confluence of factors, primarily economic ones. Let’s break down the key anxieties:

- Overvaluation: Think of the dot-com bubble. Companies with little to no revenue but promising internet ideas were valued at astronomical levels. Some analysts fear a similar scenario with AI startups. The promise is immense, but the actual returns haven’t always kept pace. As one report from the World Economic Forum details , AI adoption is still facing significant hurdles in many industries.

- Interest Rate impact on AI investments: It’s not just the AI companies to worry about; consider what the interest rate rises are doing to the valuations of tech companies across the board. Higher interest rates reduce the present value of future earnings, meaning riskier ventures (like many AI startups) become less attractive to investors.

- Infrastructure limitations: AI is reliant on energy, which puts countries like India in a tough spot since our energy infrastructure is still being built.

I initially thought this was straightforward – it’s just another tech hype cycle. But then I realized it’s more nuanced than that. It’s about understanding the underlying economic principles and how they interact with a groundbreaking, yet still nascent, technology.

The “How” | Spotting the Warning Signs in India

Now, how does this translate to India? The Indian tech market is booming, with AI startups sprouting up like mushrooms after the monsoon. But, as someone who’s been following the tech scene closely, I see a few red flags:

- Me-too AI: A lot of startups are simply replicating existing AI models with minor tweaks, hoping to cash in on the hype. Innovation should be first, with profits following.

- Talent shortage: We have a massive talent pool, but truly skilled AI engineers and researchers are still in short supply. This leads to inflated salaries and potentially compromised quality. The National Association of Software and Service Companies (NASSCOM) NASSCOM has reported on this skills gap extensively.

- Ethical considerations and AI governance: With India’s rapid adoption of AI, it’s crucial to implement ethical guidelines and regulations to prevent bias, discrimination, and misuse of this technology. The government must play a proactive role in establishing a framework for responsible AI development and deployment.

A common mistake I see people make is blindly chasing the AI dream without understanding the fundamentals. It’s crucial to do your due diligence, research the market, and assess the long-term viability of any AI-related investment or venture.

So, is the AI boom a bubble? Maybe. Maybe not. What’s undeniable is that caution is warranted. A healthy dose of skepticism can save you from getting burned. Remember, technology is at play in the financial sector as well.

But – and this is a big but – the potential of AI is also undeniable. It’s not just about hype; it’s about transformative power. The key is to separate the signal from the noise, to invest wisely, and to build sustainably.

The “Emotional” Angle | Fear of Missing Out (FOMO) vs. Sound Judgment

Let’s be real: the fear of missing out (FOMO) is a powerful motivator. Seeing others make a fortune in AI can be intoxicating. But succumbing to FOMO without careful consideration is a recipe for disaster. I initially thought this was straightforward – it’s just another tech hype cycle. But then I realized it’s more nuanced than that.

We’ve all been there – the heart-pounding anxiety of seeing others ride a wave of success while you’re stuck on the shore. The key is to channel that anxiety into research, learning, and informed decision-making. Don’t let FOMO cloud your judgment.

The AI boom could be an exciting chapter for the Indian Economy . And with proper education it can truly thrive. But it’s going to take time for that to happen.

That moment of panic when you see an AI stock soaring. We’ve all been there. Let’s walk through this together, step-by-step, so you can get back to focusing on what really matters: your financial well-being.

Investing Responsibly in the Age of AI

Investing in artificial intelligence requires a thoughtful approach, combining an understanding of technological advancements with sound financial principles. Start by thoroughly researching specific AI companies, evaluating their business models, competitive advantages, and financial health. Avoid the temptation to chase short-term gains based on hype alone.

Diversification is key to managing risk. Instead of putting all your eggs in one AI basket, consider spreading your investments across various sectors and asset classes. This approach helps mitigate potential losses if one particular AI company or industry underperforms.

Long-term growth should be your primary focus. Identify companies with sustainable business models and a clear vision for the future. Assess their ability to adapt to changing market conditions and their commitment to ethical practices.

But, remember that there are more important aspects of technology, such as gulf gas .

Navigating the AI landscape in India

As the Indian landscape embraces AI at a rapid pace, several key areas require attention to ensure sustainable growth and ethical development.

India must invest in building a robust AI infrastructure that supports research, development, and deployment of AI solutions. This includes enhancing computing power, data storage capabilities, and network connectivity to enable AI innovation across various sectors.

Education and skill development play a critical role in preparing the workforce for the AI-driven economy. By partnering with academic institutions and industry experts, India can create specialized AI courses and training programs to cultivate a skilled talent pool.

Ethical considerations and AI governance are essential to prevent bias, discrimination, and misuse of this technology. The government must play a proactive role in establishing a framework for responsible AI development and deployment.

Ultimately, financial institutions aren’t just sounding the alarm; they’re prompting a necessary conversation about the future of AI and our role in shaping it. We should also look to bank acquisition for a glimpse into the finacial sector. What you do with this information is up to you.

FAQ

What exactly is an AI bubble?

It’s when investments in AI companies are driven by hype and speculation rather than actual value, potentially leading to a market crash.

How can I tell if an AI company is overvalued?

Look at their revenue, growth rate, and compare their valuation to similar companies. If the numbers don’t add up, be cautious.

What are some ethical concerns related to AI?

Bias in algorithms, job displacement, and potential misuse of AI for surveillance or autonomous weapons.

Should I avoid investing in AI altogether?

Not necessarily. AI has immense potential, but it’s crucial to do your research and invest responsibly.

Where can I learn more about AI and its implications?

Numerous online courses, books, and articles are available. Also, follow reputable AI researchers and industry experts.

Is India well-positioned to succeed in the AI race?

India has a large talent pool and a growing tech market, but needs to address the skills gap and invest in infrastructure to fully capitalize on the AI opportunity.