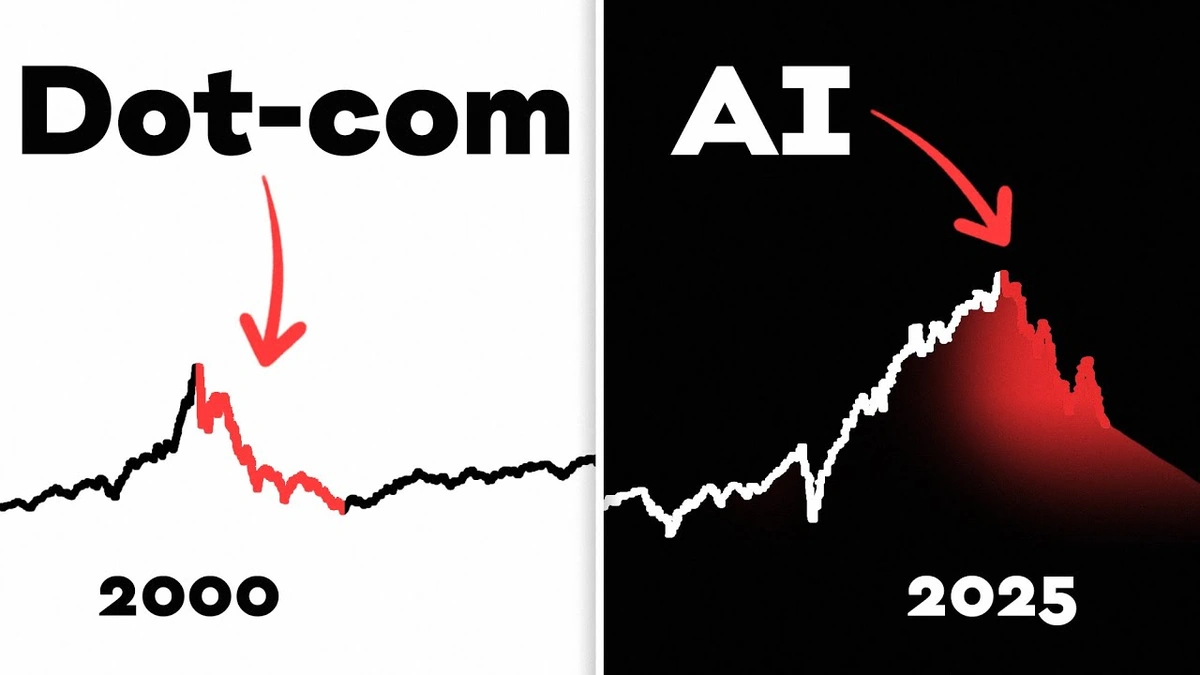

So, you’re seeing the headlines, right? AI stocks are soaring. Everyone’s talking about the next big thing, and frankly, it feels a bit… frothy. But is it justified excitement, or are we inflating an AI market bubble that’s destined to pop? Let’s dive into the heart of the matter, not just reporting what’s happening, but understanding why it matters, especially for us here in India.

The AI Gold Rush | What’s Driving This Frenzy?

It’s not just hype, though there’s plenty of that going around. Several factors are contributing to this market surge. First, there’s the sheer potential of artificial intelligence . We’re seeing real-world applications emerge across industries – from healthcare to finance to agriculture. In India, the impact could be transformative, especially in areas like precision farming and personalized medicine. That’s why investors are keen to get in early. According toInvestopedia, a bubble occurs when asset prices rise far above their intrinsic value, driven by speculation.

But, and this is a big ‘but’, the speed and scale of investment are raising eyebrows. Venture capital is pouring in at an unprecedented rate. Companies are being valued on potential, not necessarily current revenue. And that, my friends, is a classic sign of a potential bubble. Think of it like this: everyone wants a piece of the gulab jamun before it runs out, driving up the price even if it’s not the best gulab jamun in the world.

Signs of a Potential Bubble | Spotting the Red Flags

So how do we know if we’re in bubble territory? Here are a few red flags to watch out for:

- Exuberant Valuations: Are companies being valued at multiples that seem detached from reality? Are we seeing valuations based purely on future projections with very little current revenue?

- Fear of Missing Out (FOMO): Is everyone rushing to invest, afraid of being left behind? This herd mentality can drive prices up irrationally. Let’s be honest, the fear of missing out (FOMO) is a powerful force.

- Limited Understanding: Are investors truly grasping the underlying technology and its potential limitations? Or are they just jumping on the bandwagon? This is the thing I always advise my family about .

- Rapid Entry of New Players: Are new companies, often with unproven business models, flooding the market?

I initially thought it was straightforward, but then I realized that many investors, especially retail investors, may not have the expertise to differentiate between a genuinely innovative AI company and one riding the wave. It is very important to do fundamental analysis before investing.

The India Angle | Unique Opportunities and Risks

Now, let’s bring it back to India. We have a unique opportunity to leverage AI for social and economic good. Think about the potential in agriculture, education, and healthcare. But we also need to be mindful of the risks. A bursting tech bubble could have a ripple effect, impacting investment, jobs, and overall economic growth. The challenge for the Indian government and regulators will be to balance innovation with stability. The need to support the Indian startup ecosystem while protecting investors is a huge one. We have to consider venture capital funding.

One key difference in India is the relatively lower penetration of equity markets compared to developed economies. This might offer a degree of insulation, but it also means that the impact of a bubble burst could be disproportionately felt by those who are invested. This is somethingI remind my family about all the time .

Navigating the AI Landscape | Tips for Investors

So, what’s an investor to do? Here’s some practical advice, framed from my own experience and what I’ve learned from others in the market:

- Do Your Homework: Don’t just follow the crowd. Understand the technology, the business model, and the competitive landscape.

- Diversify Your Portfolio: Don’t put all your eggs in one basket, especially when it comes to a potentially volatile sector like AI.

- Invest for the Long Term: Don’t try to time the market. Focus on companies with strong fundamentals and a long-term vision.

- Be Wary of Hype: Don’t get caught up in the excitement. Stay grounded and make rational decisions.

- Consider the Source: Question everything. This is extremely important as an investor, so double check your information sources.

A common mistake I see people make is investing based on news articles or social media buzz without doing their own due diligence. Remember, nobody cares about your money as much as you do. Remember there is also a market correction risk.

The Future of AI | Beyond the Hype Cycle

Let’s be clear: AI is not going away. It’s a transformative technology that will continue to shape our world. But like any revolutionary technology, it will go through periods of hype and disillusionment. The key is to separate the signal from the noise. What fascinates me is how AI will be used to solve real problems and improve lives, not just to generate inflated valuations.

The long-term potential of AI remains enormous. But the path forward won’t be a straight line. There will be bumps, corrections, and perhaps even a bubble burst or two. The smart investor will be prepared for these challenges and focus on the fundamental value of the technology.

FAQ

What exactly is an AI market bubble?

It’s when AI-related company valuations are driven up by speculation and hype, not actual revenue or profits, similar to the dot-com bubble of the late 90s.

How can I tell if an AI company is overvalued?

Look at their revenue growth, profitability, and competitive advantage. Compare their valuation to similar companies. If the numbers don’t add up, be cautious.

What happens if the bubble bursts?

Stock prices of overvalued AI companies will plummet. It can lead to job losses and a slowdown in investment in the AI sector .

Is it too late to invest in AI?

Not at all. But be selective. Focus on companies with strong fundamentals and a clear path to profitability. The AI investment landscape is wide open.

Should I sell my AI stocks now?

That depends on your individual circumstances and risk tolerance. Consult with a financial advisor if you’re unsure.

So, is an artificial intelligence bubble imminent? Maybe. Maybe not. But even if it is, that doesn’t negate the incredible potential of AI. It just means we need to be smart, informed, and realistic about our investments. And remember, the best opportunities often arise after the initial hype has died down.