CarMax – you know, that place with all the used cars and the relentlessly cheerful commercials – has been a fixture of the automotive landscape for decades. But let’s be honest, the stock market isn’t driven by commercials. It’s about numbers, trends, and, most importantly, the future. So, is CarMax stock a solid investment in today’s unpredictable market? Or are there hidden potholes that could leave your portfolio stranded? This isn’t just another news report; it’s a deep dive into the why behind the stock’s performance, the challenges it faces, and whether it deserves a spot in your investment garage.

The Shifting Landscape of Used Car Sales

Here’s the thing: the used car market isn’t what it used to be. Remember those days of haggling with shady dealers and praying you weren’t buying a lemon? CarMax shook things up by offering a more transparent, customer-friendly experience. But the game is changing again.

Online car retailers like Carvana and Vroom – though struggling – have forced CarMax to adapt. And then there’s the whole electric vehicle (EV) revolution looming on the horizon. How does a company built on gasoline-powered vehicles navigate that shift? That’s a multi-billion dollar question. The rise of online car marketplaces and changing consumer preferences create both opportunities and threats for CarMax.

But, and this is a big but, CarMax has a few aces up its sleeve. Its extensive network of physical locations provides a tangible advantage over purely online competitors. People still like to see, touch, and test drive a car before they buy it, especially when it comes to used vehicles. Also, their financing arm gives them another way to profit. This integrated business model is something many competitors struggle to replicate.

Digging into CarMax’s Financials | More Than Meets the Eye

Numbers don’t lie…or do they? Financial statements can tell a compelling story, but you need to know how to read them. CarMax’s revenue has been…well, let’s just say it’s been a bit of a rollercoaster lately. Supply chain issues, inflation, and fluctuating consumer demand have all played a role. And while revenue is important, it’s not the whole story. Profit margins are where the rubber really meets the road.

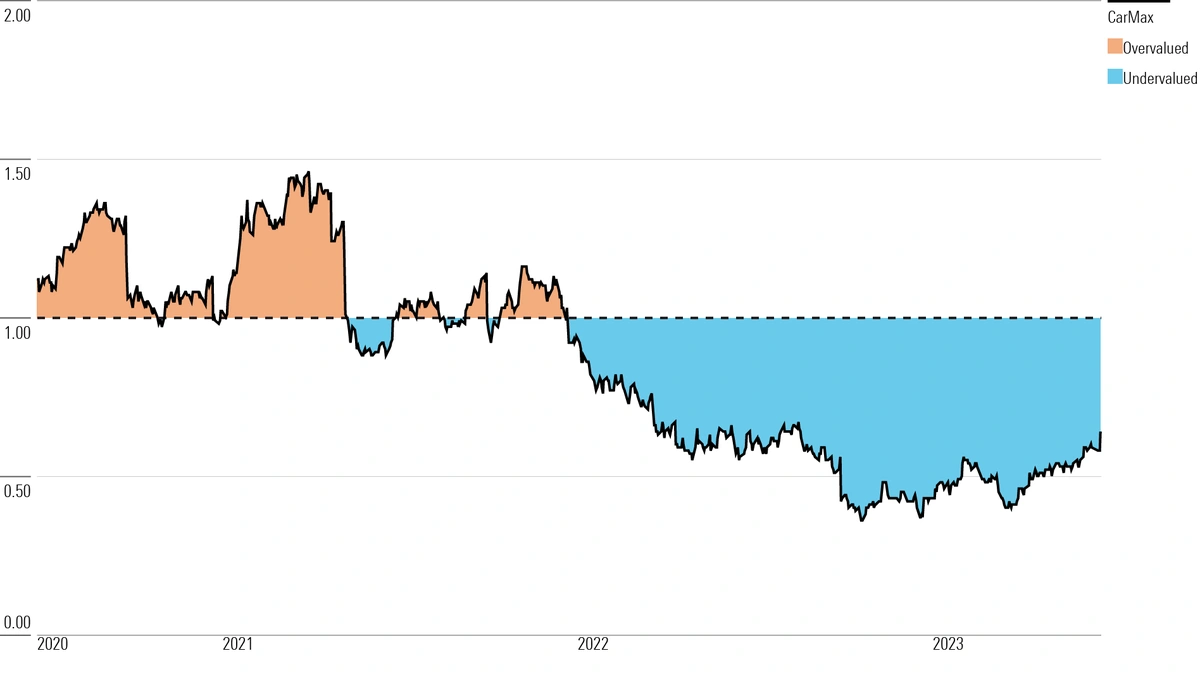

CarMax’s ability to maintain healthy profit margins in a competitive environment is crucial. Are they cutting costs effectively? Are they pricing their cars competitively? Look for trends in key metrics like gross profit per vehicle and same-store sales. A common mistake I see people make is focusing solely on revenue growth without considering profitability. CarMax’s historical performance shows periods of strong growth, but also periods where profitability was squeezed. Understanding these cycles is key to assessing the stock’s long-term potential.

And speaking of long-term potential, let’s talk about debt. Many companies, including CarMax, use debt to finance their operations and expansion. But too much debt can be a recipe for disaster, especially during economic downturns. Keeping an eye on CarMax’s debt-to-equity ratio will tell you how leveraged they are and how vulnerable they might be to financial shocks. Here’s a related article on Starbucks stock .

The EV Question | Can CarMax Adapt?

The electric vehicle revolution is no longer a distant dream – it’s happening now. And it poses a significant challenge (and opportunity) for CarMax. How do you value a used EV when the battery’s lifespan and performance are uncertain? How do you convince customers to buy a used EV when they’re worried about range anxiety and charging infrastructure?

These are not trivial questions. CarMax needs to develop strategies for appraising, reconditioning, and selling used EVs. They also need to educate their salespeople and customers about the benefits and challenges of EV ownership. The good news is, CarMax seems to be taking this seriously. They’re investing in EV infrastructure at their stores and training their staff to handle EV-related questions. Whether they can execute this transition effectively remains to be seen, but it’s a crucial factor in their long-term success. This includes battery health assessments and transparent reporting to build customer trust.

Competitive Advantages and Potential Risks

CarMax has some clear advantages, including its brand recognition, its large network of physical locations, and its financing arm. But it also faces some significant risks.

Competition from online retailers and traditional dealerships is intensifying. Economic downturns can significantly impact demand for used cars. And the shift to EVs presents both operational and financial challenges. Here’s the other internal link: Iron Hill Brewery . One key risk is the fluctuating used car prices themselves, which are tied to broader economic factors.

What fascinates me is how CarMax balances these advantages and risks. Are they investing enough in technology and training to stay ahead of the competition? Are they managing their debt prudently? Are they adapting quickly enough to the changing automotive landscape? These are the questions that will ultimately determine whether CarMax stock is a winner or a loser. According to a recent report by Cox Automotive, used car sales volume is expected to stabilize in the coming years, but pricing pressure will remain. (Cox Automotive)

Final Verdict | Should You Buy, Sell, or Hold?

So, should you invest in CarMax stock analysis ? It depends. If you’re a long-term investor who believes in the company’s ability to adapt and innovate, then it might be worth considering. If you’re a short-term trader looking for a quick profit, then you might want to look elsewhere. I initially thought this was straightforward, but then I realized that CarMax represents a bet on the future of the automotive industry. That future is uncertain, but it’s also full of potential. Ultimately, the decision is yours. But whatever you decide, do your homework, understand the risks, and don’t invest more than you can afford to lose. And remember, past performance is not always indicative of future results. This is applicable for car buying strategies or any other stock for that matter. Happy Investing!

FAQ About CarMax Stock

What factors influence CarMax stock price?

Several factors can influence CarMax’s stock price, including overall economic conditions, interest rates, competition from other car retailers, and consumer demand for used vehicles.

Is CarMax considered a growth or value stock?

CarMax is generally considered a blend of both growth and value. It has a strong track record of growth, but its stock price is also relatively low compared to its earnings.

How does the rise of EVs affect CarMax’s business?

The rise of EVs presents both challenges and opportunities for CarMax. They need to adapt their business model to handle used EVs, but they also have the potential to become a major player in the used EV market.

What are the key risks associated with investing in CarMax stock?

Key risks include increased competition, economic downturns, and the challenges of adapting to the shift towards electric vehicles.