Okay, let’s be honest – the economic news lately feels like a relentless downpour. We’re constantly bombarded with headlines about rising prices and a shaky job market. But what does it really mean for you, the average person in India trying to make ends meet? It’s not just about numbers; it’s about how you feel about those numbers – that’s consumer sentiment , and it’s taking a hit. Big time.

Why This Matters | The Domino Effect of Negative Sentiment

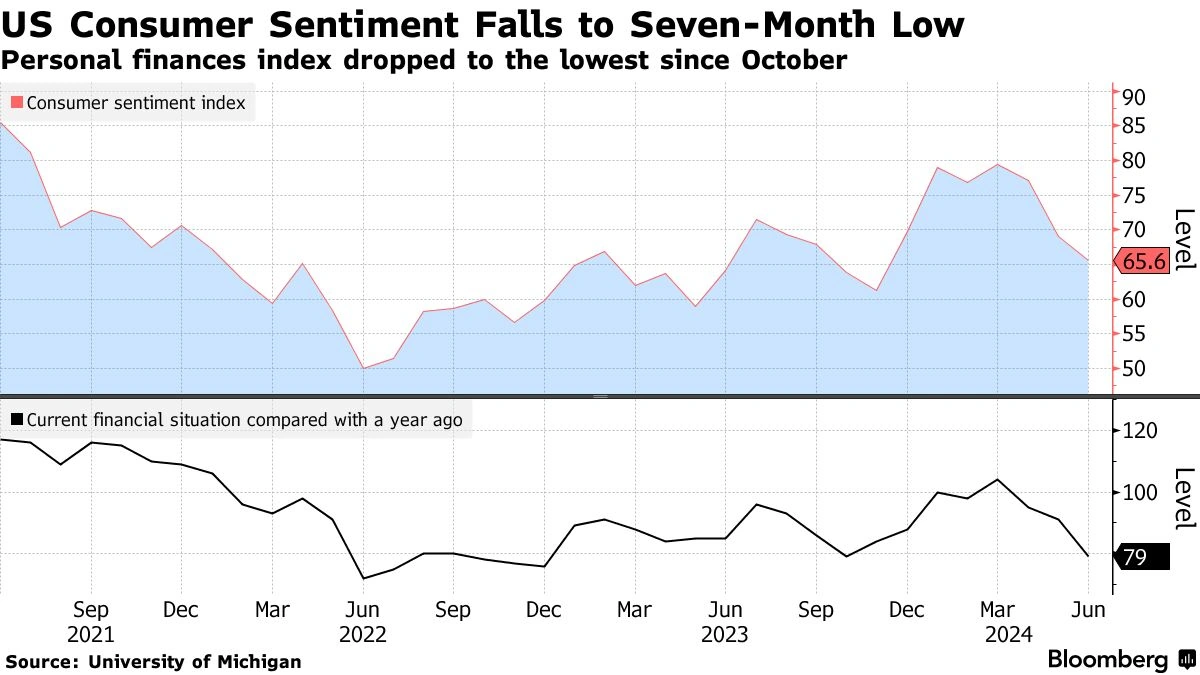

So, why should you care if consumer confidence is dropping? Here’s the thing: your feelings directly impact your spending habits. When you’re worried about the future, you’re less likely to splurge on that new gadget or plan that vacation. You hold onto your money. And when everyone does that collectively, the economy slows down. It’s a self-fulfilling prophecy of sorts. This decline in consumer sentiment reflects growing concerns about economic outlook .

But there’s more to it than just spending. A dip in consumer sentiment can also affect investment decisions. Businesses might delay expansion plans, fearing a lack of demand. Investors could become more risk-averse, pulling money out of the market. All of this contributes to a vicious cycle of economic stagnation. Consider the impact on discretionary spending, where consumers cut back on non-essential purchases due to inflation concerns .

Decoding the Data | What’s Behind the Decline?

Let’s break down the main culprits behind this plummeting consumer sentiment: rising prices and a weakening job market. It’s not rocket science, right? But it’s important to understand the nuances.

First, inflation. We’re not just talking about slightly higher prices; we’re talking about a sustained increase in the cost of everyday essentials like food, fuel, and healthcare. This directly impacts your disposable income – the money you have left after paying for necessities. When that shrinks, you have less to spend on everything else.

And then there’s the job market. While some sectors are still hiring, there are growing concerns about job security. Layoffs are making headlines, and many companies are freezing hiring plans. This creates a sense of uncertainty and anxiety among workers, further dampening consumer sentiment. This decline also signals that the current economic climate is precarious. You can see analysis on stockmarket which tells a lot about economic condition.

How This Impacts You Directly (and What You Can Do)

Okay, enough doom and gloom. What can you actually do about this? Well, you can’t single-handedly fix the economy (though that would be pretty cool). But you can take steps to protect your own financial well-being and navigate this challenging environment. Here’s the thing: knowledge is power.

First, take a close look at your budget. Identify areas where you can cut back on unnecessary spending. Consider switching to cheaper alternatives for everyday products. Look for deals and discounts. Every little bit helps. Many economists agree that prudent financial planning is essential during times of uncertainty.

Second, focus on building your skills and increasing your employability. The job market might be tough, but there are always opportunities for those who are willing to learn and adapt. Consider taking online courses or attending workshops to enhance your skills. Network with people in your industry. The stronger your skill set, the better your chances of landing a new job if you need one.

Third, don’t panic. It’s easy to get caught up in the negative news cycle, but remember that economic downturns are temporary. They don’t last forever. Stay calm, stay focused, and stay proactive. Consider investing in assets that tend to hold their value during inflationary periods, such as gold or real estate.

Fourth, stay informed. Keep an eye on economic indicators, but don’t obsess over them. Understand the trends, but don’t let them dictate your every move. Make informed decisions based on your own individual circumstances. One example is, understanding the impact of geopolitical tensions on global markets can help in informed decision-making.

Also, remember that you are not alone. It’s important to share your worries with friends and family so that you can help and support one another.

By following these steps, you can weather the storm and emerge stronger on the other side. Remember, even in tough times, there are opportunities to learn, grow, and thrive.

The Role of Government and Businesses

While individual actions are important, it’s also crucial to consider the role of government and businesses in addressing the decline in consumer sentiment trends . Government policies can play a significant role in stabilizing the economy and boosting confidence. This could include measures to control inflation, stimulate job creation, and provide support to vulnerable populations. For example, the government could implement policies to encourage investment in infrastructure, which would create jobs and boost economic activity.

Businesses also have a responsibility to act ethically and responsibly during challenging times. This includes avoiding excessive price increases, protecting jobs, and investing in employee training and development. By demonstrating a commitment to social responsibility, businesses can help to build trust and confidence among consumers. Transparency and fair practices are crucial for maintaining positive consumer financial perception .

Looking Ahead | A Glimmer of Hope?

Okay, so things look a bit bleak right now. But let’s not lose sight of the bigger picture. The Indian economy has proven its resilience time and time again. We’ve weathered far worse storms in the past, and we’ll weather this one too. There are signs that inflation is starting to moderate, and the job market is still relatively strong compared to other countries. The key is to stay informed, stay proactive, and stay resilient.

What fascinates me is how human behavior is always at the heart of economics. It’s not just about dry statistics; it’s about how we collectively react to them.

FAQ | Your Burning Questions Answered

What if I lose my job?

Update your resume, network aggressively, and explore government assistance programs.

How can I save money on groceries?

Plan your meals, buy in bulk, and compare prices at different stores.

Is it a good time to invest in the stock market?

It depends on your risk tolerance and long-term goals. Consult a financial advisor.

What government schemes can help me?

Explore programs like MGNREGA and various skill development initiatives.

How do I deal with financial stress?

Talk to a trusted friend or family member, or seek professional help.

So, there you have it. Consumer sentiment might be down, but we’re not out. By understanding the challenges, taking proactive steps, and supporting each other, we can navigate these turbulent times and build a stronger, more resilient future. The Indian spirit, after all, is not easily broken. Let’s keep that in mind.