Okay, let’s be real. When you hear “Costco earnings,” do your eyes glaze over? It’s easy to think, “Another corporate report, who cares?” But stick with me, because the story behind Costco ‘s financial performance reveals a lot about the American economy, consumer behavior, and even the future of retail. It’s not just about bulk toilet paper and free samples – although, let’s be honest, those are perks. Let’s dig in.

What the Headlines Miss About Costco’s Success

You’ll see reports about revenue, profits, and membership growth. Blah, blah, blah. The real story is why Costco continues to thrive when other retailers are struggling. And it boils down to a few key things. First, their membership model is genius. People pay upfront for the privilege of shopping there, creating a loyal customer base. Second, they offer incredible value, and consumers are trading down and seeking value. Costco acts as a hedge against inflation. Third, they know their customer. They understand what drives people to spend money, even when times are tough. This is important. The latest Powell speech indicates that inflationary pressures are very present; Costco is where consumers go to combat this.

The Hidden Implications for Consumers

Costco’s earnings aren’t just numbers on a spreadsheet; they are leading indicators of what consumers are doing. Are people willing to spend on discretionary items? Are they stocking up on essentials? Are they feeling confident about the future? Costco ‘s sales data offers a peek into the collective mindset of the American shopper. If Costco is doing well, it suggests that, despite economic uncertainty, people are still spending. Costco’s membership renewal rates , for example, are insanely high. That says something profound about their perceived value. But, if sales start to dip, it could signal a pullback in consumer spending – a potential warning sign for the broader economy.

Decoding Costco’s Inventory Strategy | A Lesson in Supply Chain Management

One aspect of analyzing Costco’s earnings that often goes unnoticed is their inventory strategy. Costco doesn’t just buy products; they strategically manage their supply chain to minimize costs and maximize value for their members. They often buy in bulk (obviously!), negotiate favorable deals with suppliers, and even import goods directly to cut out the middleman. This allows them to offer lower prices than traditional retailers, further solidifying their appeal to price-conscious consumers. What fascinates me is how they balance this with the need to keep their inventory fresh and appealing. It’s a constant juggling act, and their earnings reports offer clues into how well they’re managing it. They’re incredibly good at understanding PCE growth.

Beyond the Price Tag | The Emotional Connection to Costco

Here’s the thing: Costco isn’t just a store; it’s an experience. There’s a certain thrill to wandering those wide aisles, discovering unexpected deals, and snagging a rotisserie chicken for $4.99. It’s a treasure hunt, a social outing, and a source of comfort all rolled into one. And that emotional connection is a powerful driver of loyalty. I initially thought this was straightforward, but then I realized this experience has been painstakingly engineered. Think about it: the free samples, the oversized shopping carts, the sheer volume of merchandise. It’s all designed to create a sense of abundance and excitement. And that’s something you can’t measure with a simple earnings report, but it’s a critical factor in Costco’s continued success. The buzz is very real.

So, What Does It All Mean?

Ultimately, Costco’s earnings tell a story about the resilience of the American consumer, the power of value, and the importance of building strong relationships with customers. It’s not just about selling stuff; it’s about creating an experience that people love and trust. As other retailers struggle to adapt to a changing landscape, Costco remains a beacon of stability and success. By paying attention to the nuances of their earnings reports, we can gain valuable insights into the broader trends shaping the economy and the future of retail. And that, my friends, is why Costco earnings matter more than you think. As of late, consumers have been trading down and this trend benefits Costco.

FAQ | Understanding Costco Earnings

What are Costco’s primary sources of revenue?

Costco generates revenue from two main sources: membership fees and merchandise sales.

How often does Costco report its earnings?

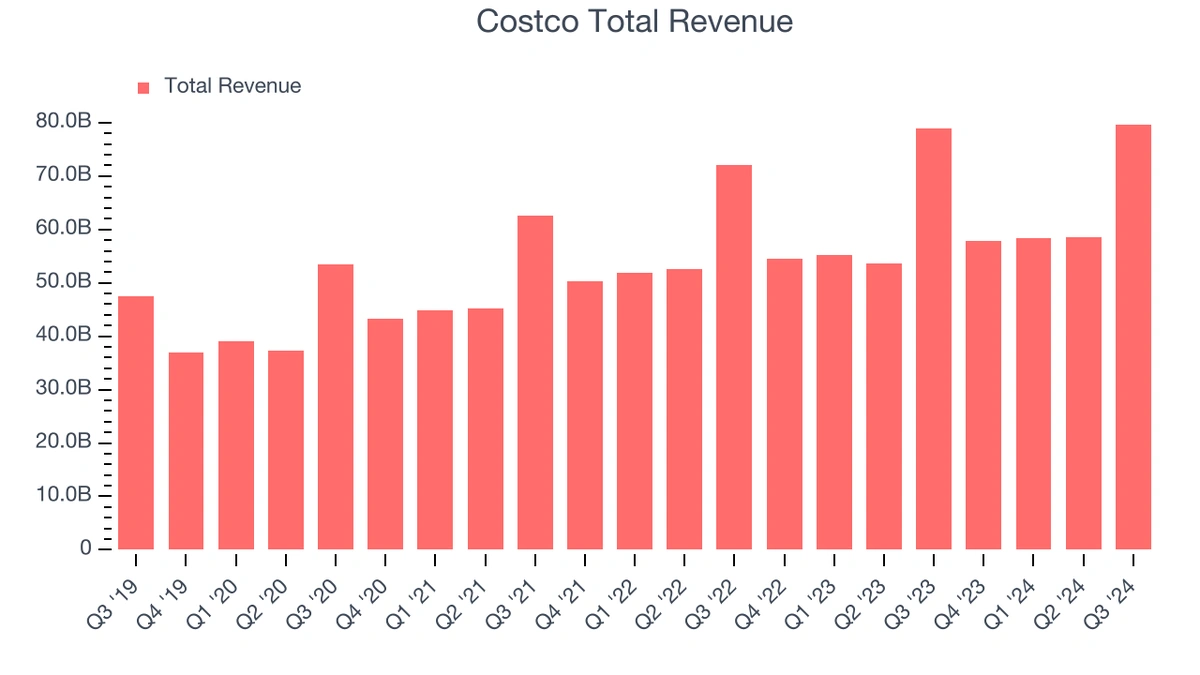

Costco reports its earnings on a quarterly basis, typically in December, March, May, and August.

What key metrics should I look for in a Costco earnings report?

Pay attention to membership growth, renewal rates, same-store sales growth, and gross margin. These metrics provide insights into Costco’s overall performance and profitability.

Where can I find Costco’s earnings reports?

You can find Costco’s earnings reports on their investor relations website or through financial news outlets.

How do Costco ‘s digital sales impact their overall earnings?

E-commerce sales are an increasingly important factor. Increased digital sales can offset slower growth in brick-and-mortar locations.