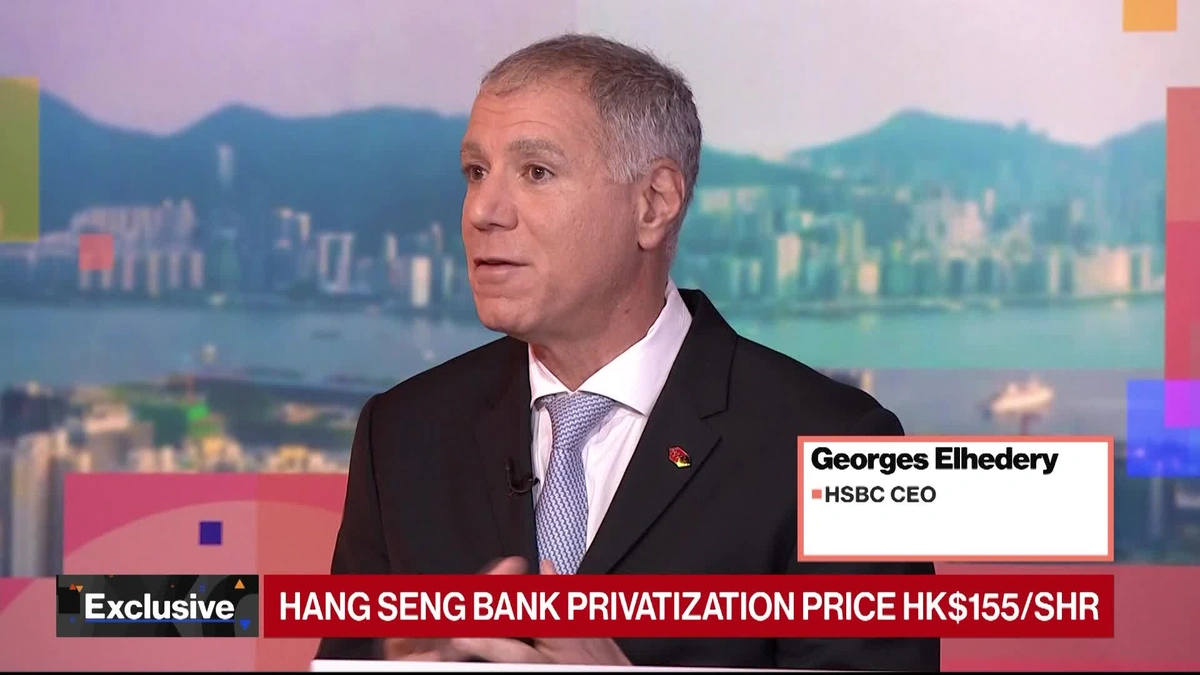

Okay, let’s talk about something that’s making waves in the financial world – the potential Hang Seng Bank Privatisation . HSBC, a name we all recognise, just dropped a bombshell: a $13.6 billion plan involving Hong Kong’s Hang Seng Bank. Now, before your eyes glaze over, stick with me. This isn’t just about numbers; it’s about what this move means, especially if you’re watching the markets closely from India.

I know, I know. Finance news can sound like a foreign language. But here’s the thing: understanding these shifts can give you a serious edge. So, let’s break down why HSBC might be considering this, what it could mean for the bank, and, most importantly, what ripple effects we might see all the way over here. Think of it as financial tea leaves – let’s read them together.

The “Why” | Unpacking HSBC’s Strategy

So, why would HSBC even consider such a massive move? Well, let’s be honest, banks aren’t exactly known for their impulsive decisions. There’s almost certainly some strategy afoot. One key factor is probably the changing global economic landscape. Big banks are constantly re-evaluating their portfolios, and sometimes, that means streamlining operations or focusing on core markets.

Another possibility? Regulatory pressures. Financial institutions are under increasing scrutiny, and sometimes, divesting certain assets can make compliance easier and reduce risk. It could also free up capital for HSBC to invest in other, potentially more lucrative, areas. Now, this HSBC strategic review isn’t explicitly stated in the initial announcement, but if you follow the money like I do, it’s a pretty safe bet. And let’s not forget the potential for unlocking shareholder value. Sometimes, a company is worth more in pieces than as a whole. The potential sale of Hang Seng Bank shares could boost HSBC’s stock price and return cash to investors.

But there’s another angle that’s fascinating: the changing dynamics within Hong Kong itself. As Hong Kong navigates its relationship with mainland China, there could be strategic considerations influencing HSBC’s decision. Navigating the complexities of the Hong Kong banking sector requires careful consideration, and sometimes that means making tough choices.

Hang Seng Bank | More Than Just a Name

Okay, let’s zoom in on Hang Seng Bank itself. It’s not just some random financial institution; it’s a major player in Hong Kong. Understanding its significance is crucial. Think of it as a bellwether for the Hong Kong economy. The future of Hang Seng Bank is closely intertwined with the city’s overall financial health. Its performance reflects the broader economic trends and investor sentiment in the region.

I initially thought of Hang Seng as just another bank, but, after doing a little digging, I found that it has deep roots and a long history in Hong Kong. It’s more than just a place to deposit your paycheck; it’s woven into the fabric of the city’s financial system. It also plays a vital role in providing financial services to individuals and businesses in Hong Kong and mainland China. And if HSBC reduces its stake, what does it mean for existing Hang Seng customers? Will they even notice a change? Probably not immediately, but the long-term implications could be significant.

Ripple Effects for Indian Investors?

Now, let’s bring this back home to India. Why should you, sitting in your favourite cafe in Bangalore or Mumbai, care about what’s happening with a bank in Hong Kong? Because global finance is interconnected. The decision of HSBC to privatise Hang Seng Bank could impact Indian markets and investors in several ways.

Firstly, it could influence investor sentiment towards emerging markets in general. If HSBC is pulling back from Hong Kong, it might signal a broader shift in investment strategy. This could, in turn, affect the flow of capital into other Asian markets, including India. Moreover, the potential impact on HSBC stock could have indirect consequences for Indian investors who hold HSBC shares or invest in funds that own them. And let’s not forget the currency exchange rates. Major financial moves like this can ripple through the currency markets, potentially affecting the value of the Indian rupee. Keep an eye on how the Hong Kong dollar and other Asian currencies react in the coming weeks.

Consider this: If other major players follow suit and re-evaluate their positions in Asia, we could see a significant reshuffling of the global financial landscape. It is very important to analyse the implications of bank privatisation . This could create both challenges and opportunities for Indian businesses and investors. Smart investors will be watching closely and adapting their strategies accordingly.

What Happens Next? A Few Thoughts

So, what’s the takeaway here? The HSBC announcement is more than just a headline; it’s a signal. It tells us about shifting priorities, evolving market dynamics, and the interconnectedness of the global financial system. I am also closely following the regulatory approval process . The privatisation plan will be subject to scrutiny by regulators in Hong Kong and other relevant jurisdictions.

But – and this is important – it’s not a cause for panic. Instead, it’s an opportunity to learn, adapt, and make informed decisions. Keep an eye on the developments, do your research, and don’t be afraid to ask questions. This move towards Hang Seng Bank independent ownership could open doors for other entities, including those from India, to increase their influence in the Hong Kong market.

Remember, the world of finance is constantly evolving. What fascinates me is the ability to see it as less about scary numbers and more about the human element – the decisions, the strategies, and the ultimate quest for growth and stability. And that’s something we can all relate to, no matter where we are in the world.

Here’s a link to a related article about global economic trends. Here is another one on rddt stock .

FAQ Section

Will this affect my Hang Seng Bank account if I’m an international customer?

Probably not directly in the short term. However, keep an eye on any official communications from the bank regarding changes to terms and conditions.

Could this lead to similar moves by other banks in Asia?

It’s possible. Major financial institutions often watch each other’s moves closely, so this could set a precedent. It is crucial to monitor future market trends .

Where can I find more information about HSBC’s plans?

Check out HSBC’s official investor relations website for press releases and financial reports. You can also find more information on the Hong Kong stock exchange .

What does “privatisation” actually mean in this context?

It means that HSBC is planning to reduce its ownership stake in Hang Seng Bank, potentially leading to a more independent ownership structure.

How will this affect the Hong Kong stock market?

It is difficult to say, the Hong Kong stock market reaction remains to be seen, but any news from big names can cause volatility, so keep a close eye on market indices and analyst reports.

Should I be worried about my investments in Hong Kong?

Not necessarily. It’s always wise to diversify your portfolio and stay informed, but this news doesn’t automatically mean you should panic. Seek advice from a financial advisor if you’re concerned.