LAC stock – you’ve probably seen it mentioned in passing, maybe even caught a headline or two. But let’s be honest, unless you’re deep in the weeds of the market, it might just seem like another ticker symbol. Here’s the thing: there’s a lot more to the story than meets the eye. It’s not just about the price going up or down; it’s about why it’s happening and what it says about the broader trends shaping the world we live in. So, grab your coffee, and let’s dive in.

The “Why” Behind the Buzz | Untangling the Threads

Why is there buzz around Lithium Americas Corp stock? I initially thought it was straightforward – lithium, electric vehicles, boom. But then I realized it’s much more complex than a simple supply-demand equation. The lithium market is driven by several factors: increasing demand for electric vehicles, of course, but also geopolitical tensions, environmental concerns, and technological advancements in battery production. According to the latest reports, government regulations and subsidies are also playing a significant role in lithium mining and production.

And then there’s the human element. See, investing isn’t just about spreadsheets and algorithms. It’s about betting on people, on their vision and their ability to execute. Are the management team at Lithium Americas Corp capable of navigating the challenges ahead? What are their plans for sustainable extraction? How will they address community concerns? These are the questions that really matter, the ones that can make or break a company’s long-term prospects.

Beyond the Hype | Real-World Implications for the Average Joe

Okay, so a company mines lithium. Big deal, right? Wrong. The price of lithium carbonate directly affects the cost of electric vehicle batteries, which in turn influences the affordability of EVs for everyday Americans. If LAC succeeds in scaling up production efficiently and sustainably, it could help drive down the price of EVs, making them accessible to a wider range of consumers.

This, in turn, could accelerate the transition to a greener economy and reduce our reliance on fossil fuels. It’s a ripple effect that touches everything from air quality in our cities to the health of our planet. Consider that the stock market can be a wild ride, see what’s happening at Stock Market Open Today .

The Lithium Landscape | Navigating the Risks and Rewards

Let’s be honest, investing in any mining stock is inherently risky. There are environmental regulations to navigate, community relations to manage, and fluctuating commodity prices to contend with. And in the case of lithium, the competition is fierce, with companies from around the world vying for a piece of the pie.

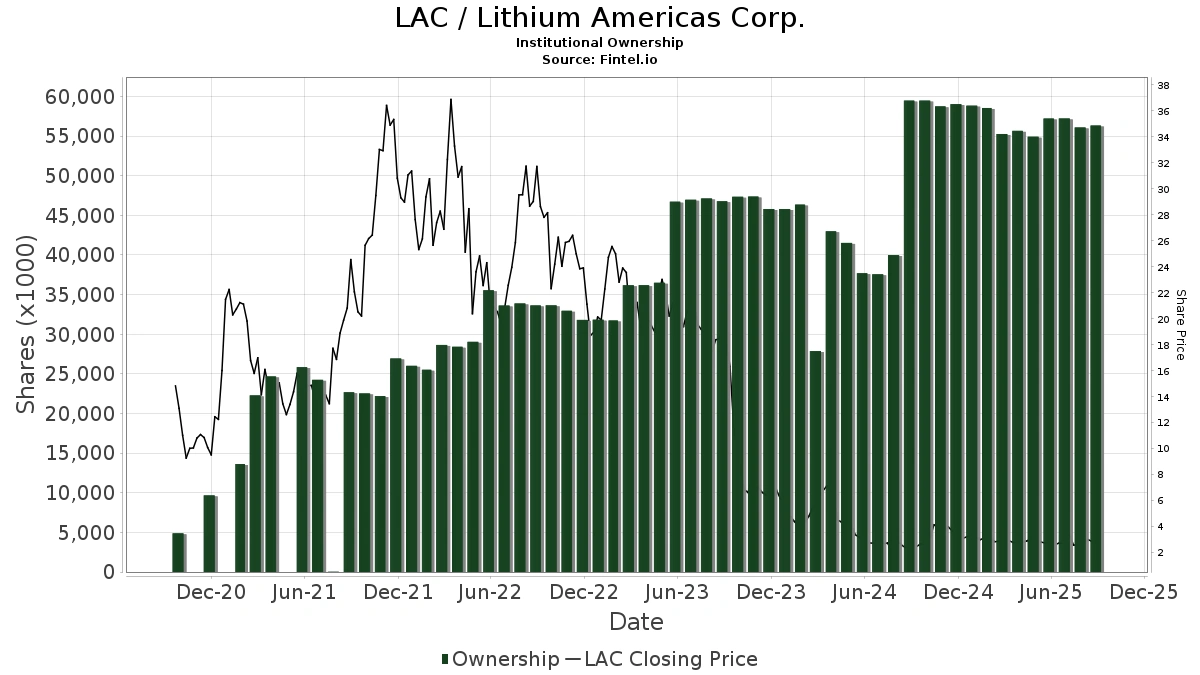

A common mistake I see people make is not doing enough due diligence. Don’t just blindly follow the hype. Read the company’s financial reports, understand the geopolitical landscape, and assess the environmental risks associated with their operations. Is the company using sustainable mining practices? What are their plans for mitigating environmental damage? These are questions you need to ask before putting your hard-earned money on the line. Do your research and understand the factors affecting LAC share price .

What the Future Holds | Predictions and Possibilities

Trying to predict the future of any stock is a fool’s errand. But we can look at the trends and make educated guesses. The demand for lithium is only going to increase in the coming years as electric vehicles become more mainstream. But the question is whether LAC can scale up its production quickly enough to meet that demand. A key thing to look at is the lithium supply chain .

And, of course, there’s the wild card of technological innovation. What if a new battery technology emerges that doesn’t rely on lithium? What if a more efficient and sustainable mining process is developed? These are the unknowns that keep investors up at night. But that’s also what makes the market so fascinating. The energy market is certainly in interesting place, if you want to compare, here’s a post about First Energy .

The Takeaway | Stay Informed, Stay Curious

So, is LAC stock a good investment? I’m not going to tell you what to do with your money. But I hope I’ve given you a better understanding of the complexities involved. The world of lithium mining is a microcosm of the larger forces shaping our economy and our planet. It’s about technology, geopolitics, and sustainability all rolled into one. Stay informed, stay curious, and always remember that investing is a marathon, not a sprint.

FAQ About LAC Stock

What is Lithium Americas Corp?

Lithium Americas Corp (LAC) is a company focused on advancing lithium projects. They are involved in the exploration and development of lithium resources, which are crucial for batteries used in electric vehicles and energy storage systems.

Why is lithium demand increasing?

The demand for lithium is primarily driven by the growth of the electric vehicle market. Lithium-ion batteries are the dominant technology for powering EVs, leading to increased demand for lithium as a key component.

What are the risks associated with investing in LAC?

Investing in LAC, like any mining company, involves risks such as fluctuating commodity prices, environmental regulations, geopolitical factors, and the success of their projects in meeting production targets. These factors can affect the stock’s performance.

How does lithium extraction impact the environment?

Lithium extraction can have environmental impacts, including water consumption, habitat disruption, and potential pollution. Sustainable mining practices and responsible environmental management are crucial for mitigating these effects.

Where can I find more information about LAC’s projects?

You can find detailed information about LAC’s projects on their official website and in their financial reports. These resources provide updates on project development, environmental assessments, and community engagement.

What factors influence the price of lithium?

Several factors influence the price of lithium, including supply and demand dynamics, production costs, technological advancements in battery technology, and geopolitical events affecting lithium-producing regions.