Okay, let’s talk mortgage interest rates . It’s a topic that can make even the most financially savvy among us glaze over. But here’s the thing: understanding what’s happening with interest rates, and why , is absolutely crucial if you’re thinking about buying a home, refinancing, or even just trying to make sense of the current economic landscape. So, grab your coffee (or tea), and let’s break it down in a way that actually makes sense.

Why Are Mortgage Interest Rates Always Changing?

This is the million-dollar question, isn’t it? You see the headlines – “Mortgage Rates Surge!” or “Rates Hit Record Low!” – and wonder what on earth is going on. The truth is, mortgage rates are influenced by a whole bunch of factors, kind of like a complex dance with many partners. The Federal Reserve’s monetary policy plays a huge role. Changes to the federal funds rate can trickle down, affecting theyield on treasury bonds, which in turn influences mortgage rates. But, and this is a big ‘but’, it’s not just the Fed. Inflation expectations, economic growth, and even global events can all have an impact. It’s also about investor confidence – or lack thereof.

Let me rephrase that for clarity: When investors feel good about the economy, they’re more willing to take risks, which can push bond yields (and consequently, mortgage rates) higher. When there’s uncertainty, they flock to the safety of bonds, driving yields down. See how interconnected it all is?

How Do Mortgage Rates Affect Your Buying Power?

This is where it gets personal. Your mortgage rate directly impacts how much house you can afford. A seemingly small change can have a huge effect on your monthly payments and the total amount you’ll pay over the life of the loan. A common mistake I see people make is focusing solely on the interest rate without considering the other costs involved, such as property taxes, insurance, and potential HOA fees. The higher the rate, the more of your monthly payment goes toward interest, and the less goes toward actually paying down the principal. The term “effective interest rate” also includes these other fees.

Let’s illustrate. Imagine you’re pre-approved for a $300,000 mortgage. At a 6% interest rate, your monthly principal and interest payment might be around $1,800. But if rates jump to 7%, that payment could climb to over $2,000. That extra $200 a month can seriously impact your budget, and it could mean you have to scale back your home-buying plans. This also affects your home affordability. Consider the long-term impact. Over 30 years, that seemingly small difference can add up to tens of thousands of dollars in extra interest paid.

Navigating the Current Mortgage Landscape

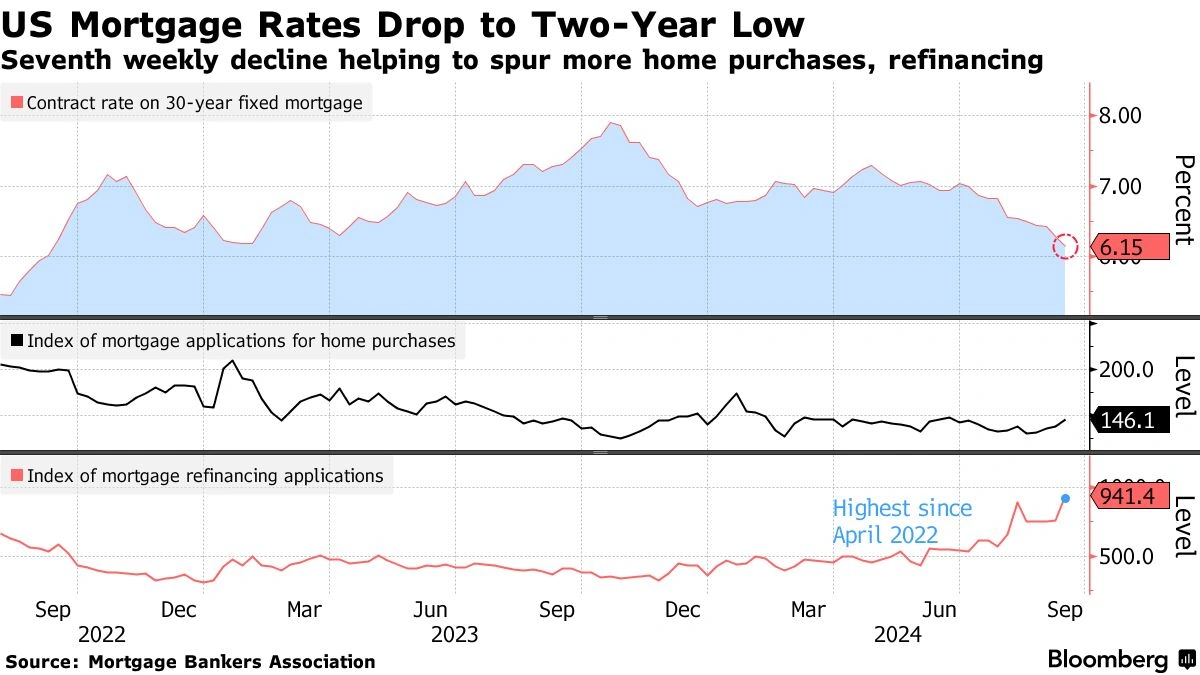

Okay, so what’s happening right now? The truth is, predicting the future of mortgage rates is like trying to predict the weather – you can make educated guesses, but you’re never 100% sure. Several factors are contributing to the current volatility. One, inflation is still a concern, even though it has cooled somewhat. Two, the Federal Reserve is still trying to walk a tightrope, balancing the need to control inflation with the desire to avoid triggering a recession. This economic uncertainty creates challenges.

And three, global events can always throw a wrench into the works. A geopolitical crisis, a major economic slowdown in another country – these can all send ripples through the financial markets and impact interest rates. That’s why it’s so important to stay informed and work with a trusted mortgage professional who can help you navigate the ever-changing landscape.

Tips for Securing the Best Mortgage Rate

So, what can you actually do to improve your chances of getting a good rate? Well, here’s my advice, based on what I’ve seen work: First and foremost, get your financial house in order. That means improving your credit score, paying down debt, and saving up for a larger down payment. The higher your credit score, the lower the interest rate you’re likely to qualify for. A larger down payment not only reduces the amount you need to borrow but also signals to lenders that you’re a lower-risk borrower. I initially thought this was straightforward, but then I realized how many people don’t know their credit score.

Secondly, shop around! Don’t just go with the first lender you talk to. Get quotes from multiple lenders and compare their rates and fees. And don’t be afraid to negotiate. Lenders want your business, and they may be willing to lower their rates or waive fees to win you over. Thirdly, consider different types of mortgages. A fixed-rate mortgage offers stability, as your interest rate remains the same for the life of the loan. But an adjustable-rate mortgage (ARM) might offer a lower initial rate, although that rate can change over time. Finally, don’t rush. Take your time to research your options and make sure you’re comfortable with the terms of the loan before you sign on the dotted line. Buying a home is a huge decision, and you don’t want to make it in haste.

And , consider reaching out to mortgage professionals to get personalized advice and insights.

The Future of Mortgage Rates | What to Watch For

Predicting the future is always a risky game. However, keep an eye on several key indicators. Inflation reports will be crucial in determining the Federal Reserve’s next moves. Strong economic growth could put upward pressure on rates, while a slowdown could lead to lower rates. Keep up-to-date with the latest economic news, but remember that no one has a crystal ball. The housing market outlook is still uncertain.

And don’t forget to consult with a financial advisor to get personalized advice based on your specific circumstances. They can help you assess your risk tolerance, set financial goals, and develop a strategy for achieving them. Also, remember that while mortgage rate trends are important, they shouldn’t paralyze you. It’s still possible to find the right home loan.

In conclusion, the world of mortgage interest rates can be daunting, but it doesn’t have to be. By understanding the factors that influence rates, taking steps to improve your financial profile, and working with trusted professionals, you can navigate the market with confidence and achieve your homeownership goals. That is a crucial component of the American Dream .

FAQ | Mortgage Interest Rates Explained

What if I have a low credit score?

A low credit score will likely result in a higher interest rate. Focus on improving your credit score by paying bills on time and reducing debt before applying.

Are adjustable-rate mortgages a good idea?

It depends on your risk tolerance and how long you plan to stay in the home. ARMs can offer lower initial rates, but they can also increase over time.

How much of a down payment do I need?

While some loans require as little as 3% down, a larger down payment (20% or more) can result in a lower interest rate and avoid private mortgage insurance (PMI).

What are points on a mortgage?

Points are fees you pay to the lender in exchange for a lower interest rate. One point equals 1% of the loan amount.

Should I lock in my interest rate?

If you’re happy with the current rate and expect rates to rise, locking in can provide peace of mind. However, if you think rates might fall, you could wait.

What is APR?

Annual Percentage Rate (APR) is a broader measure than the interest rate, as it includes other loan costs like fees, mortgage insurance, and points expressed as a yearly rate. It gives a truer picture of the total cost of the mortgage.