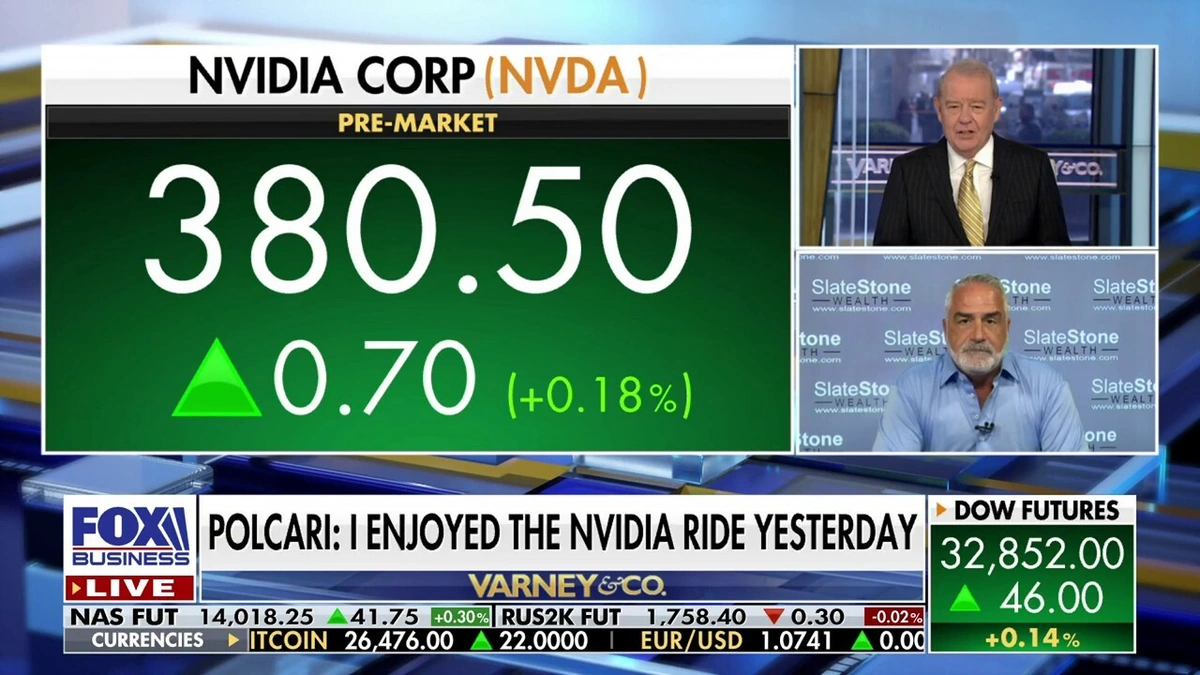

Okay, let’s talk NVDA premarket . You’ve seen the headlines, maybe a few green arrows, maybe a scary red one. But what does it all mean, especially for us here in India? Here’s the thing: premarket activity isn’t just noise. It’s a sneak peek, a glimpse behind the curtain before the big show opens on Wall Street.

Why NVDA Premarket Matters (More Than You Think)

So, why should you care about NVDA’s premarket performance ? It’s not just about day traders trying to make a quick buck. Premarket trading often reflects overnight news, global market sentiment, and, crucially, analyst upgrades or downgrades. Think of it as the market’s initial reaction – sometimes rational, sometimes driven by pure emotion. Understanding these early signals can give you, the savvy Indian investor, an edge. For instance, a positive premarket surge could signal increased confidence in NVDA’s growth prospects, which might be linked to the rising demand for AI chips – a sector where NVDA is a major player. More business related insight can be found here .

But, and this is a big but, premarket isn’t always predictive. It’s like reading tea leaves – you need to know what to look for and how to interpret it. Small volume, for example, can lead to exaggerated price swings. A few big players can easily manipulate the price, creating a false sense of optimism (or doom). It is important to understand stock market trends .

Reading the Tea Leaves | Key Factors Influencing NVDA Premarket

Let’s break down the things that typically influence NVDA’s premarket moves. We are talking about the impact on NVDA’s stock price .

- Earnings Reports (and Whispers): Did NVDA just release its earnings? Or is there anticipation building for an upcoming report? Even rumors or leaked information can send the premarket into a frenzy. I’ve seen stocks jump (or plummet) based on nothing more than speculation.

- Analyst Ratings: Keep an eye out for those analyst upgrades or downgrades from firms like Morgan Stanley or Goldman Sachs. These ratings can carry significant weight, especially if they’re accompanied by detailed reports outlining the reasons behind the change. Always consider this as you make investment decisions.

- Global News & Geopolitics: Major global events – economic data releases, political tensions, or even natural disasters – can all impact market sentiment and, in turn, NVDA’s premarket performance. The interconnectedness of the global economy means what happens in Washington or Beijing can affect your portfolio in Mumbai.

- Semiconductor Sector News: Any major news impacting the semiconductor industry as a whole will inevitably affect NVDA. This could include announcements from competitors like AMD, regulatory changes, or supply chain disruptions.

How to Use Premarket Data Wisely (Without Getting Burned)

Okay, so you’re armed with some knowledge. But how do you actually use this information to make smart investment decisions? Here’s the practical guide:

- Check the Volume: Low volume = unreliable signal. Look for premarket activity with significant trading volume to get a more accurate picture.

- Consider the Context: Don’t just react to the price movement. Dig deeper. What news is driving the move? Is it a short-term blip or a fundamental shift?

- Don’t FOMO: The fear of missing out (FOMO) is a dangerous thing in the stock market. Just because NVDA is surging in the premarket doesn’t mean you should blindly jump in. Have a plan, stick to your strategy, and don’t let emotions dictate your decisions.

- Use Technical Analysis (with Caution): Premarket data can be used in conjunction with technical analysis tools to identify potential entry or exit points. But remember, premarket trends can be volatile. As volatility in premarket trading can lead to rapid changes in price.

- Remember the Big Picture: Premarket activity is just one piece of the puzzle. Always consider NVDA’s long-term fundamentals, its competitive position, and the overall market environment before making any investment decisions.

And remember – diversification is your friend. Don’t put all your eggs in one basket, no matter how tempting NVDA’s premarket performance may look. Also, consider reviewing a stock market analysis to get additional insight.

Beyond the Numbers | The Human Element

What fascinates me is the psychology behind market movements. It’s not just about numbers; it’s about people. Fear, greed, hope – these emotions drive buying and selling decisions, especially in the volatile premarket environment. Understanding this human element can give you a deeper understanding of market dynamics. Consider other market influencers to gain insight.

The stock market is a complex beast, and premarket trading adds another layer of complexity. The volatility of NVDA premarket trading should be considered when making investment decisions.

The Future of Premarket Trading in India

While premarket trading isn’t as widely accessible in India as it is in the US, its importance is growing as more and more Indian investors participate in global markets. As technology evolves and regulations adapt, we’re likely to see increased access to premarket data and trading opportunities for Indian investors. This means understanding premarket dynamics will become even more crucial for success. The growing interest in NVDA stocks is worth noting as well.

So, the next time you see NVDA’s premarket flashing green or red, don’t just react. Take a deep breath, analyze the situation, and remember the advice of that slightly quirky friend in the coffee shop. And remember, investing is a marathon, not a sprint. Stay informed, stay rational, and stay diversified.

FAQ | Your NVDA Premarket Questions Answered

What exactly is premarket trading?

It’s trading that happens before the official stock market opening bell. It’s a chance for investors to react to overnight news and events.

Is premarket data available in India?

Yes, you can find premarket data on various financial websites and trading platforms. Look for reputable sources that provide real-time information.

Can I trade NVDA in the premarket from India?

It depends on your broker. Some brokers offer premarket trading access, while others don’t. Check with your broker to see if they offer this service.

What are the risks of premarket trading?

Higher volatility, lower liquidity, and the potential for manipulation are all risks to be aware of.

How reliable is premarket data?

It can be a useful indicator, but it’s not always predictive of the day’s overall performance. Use it in conjunction with other analysis tools.