Okay, let’s talk oil prices . It’s one of those things that quietly hums in the background of our lives, influencing everything from your morning commute to the cost of, well, pretty much everything. Right now, we’re seeing a bit of a stalemate, a pause in the usual price rollercoaster. But why ? That’s what we’re going to unpack today. Not just the what, but the why, and more importantly, what it all means for you, sitting there in India, trying to figure out if you should fill up your tank this week.

Gaza Ceasefire Hopes | A Temporary Breather?

The big headline is that there are considerations for a ceasefire in Gaza. Now, geopolitics and oil market are weirdly intertwined. Think of it like this: any hint of stability in a volatile region tends to calm the nerves of investors. And calm investors are less likely to bid up the price of crude oil out of fear of supply disruptions. Here’s the thing: this is all based on potential. Ceasefire considerations aren’t the same as a signed agreement. It’s like planning a wedding – you can have the venue booked, but until you say ‘I do,’ anything can happen.

So, what does this mean for your wallet? Potentially, a slight reprieve. If the ceasefire gains traction, we might see continued stability, or even a slight dip, in fuel costs . But, and this is a big ‘but,’ don’t go planning a road trip just yet. This is one piece of a much larger puzzle.

Ukraine Negotiation Setbacks | The Unpredictable Wildcard

On the other side of the world, the situation in Ukraine remains…well, let’s be honest, it’s a mess. Negotiations are faltering, and the conflict drags on. And that has a direct impact on global oil supply . Ukraine isn’t a major oil producer itself, but the conflict has massive implications for Russian oil exports, which are a big deal. Sanctions, disrupted infrastructure, and general instability all contribute to uncertainty in the market.

What fascinates me is how these two seemingly unrelated conflicts – Gaza and Ukraine – are simultaneously tugging at oil prices in opposite directions. One offers a glimmer of hope for stability, the other continues to fuel (pun intended!) uncertainty. It’s a constant push and pull. Click here for more on market volatility .

The Indian Consumer | Navigating the Price Maze

Okay, so we’ve established the global context. But how does this translate to the everyday reality for someone in India? Well, India imports a significant chunk of its oil demand , making it particularly vulnerable to price fluctuations. The government also plays a role through taxes and subsidies, which can either amplify or dampen the impact of global price changes. The one thing you absolutely must is to remember that the price you see at the pump is a complex equation with many variables.

A common mistake I see people make is reacting to every single headline. Oil prices are notoriously volatile, and trying to time the market perfectly is a fool’s errand. A better strategy is to focus on long-term trends and adjust your consumption habits accordingly. Think about it – can you carpool more often? Are there opportunities to use public transportation? Small changes can add up.

Looking Ahead | What to Watch For

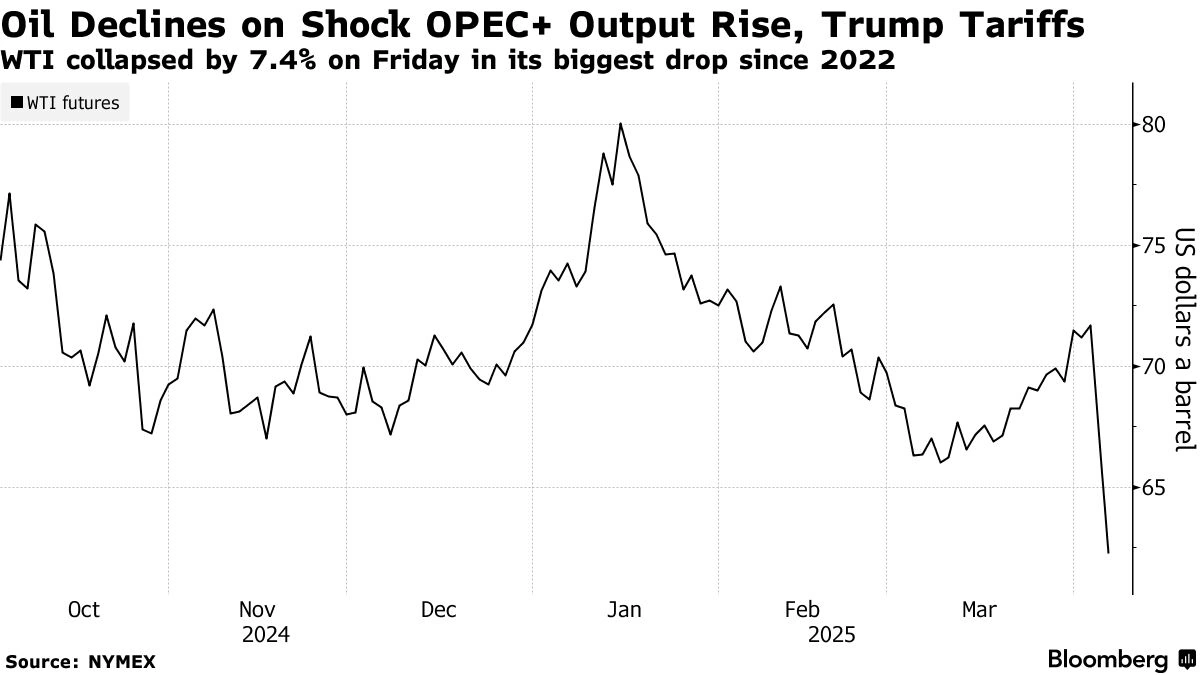

So, what should you be keeping an eye on in the coming weeks and months? Here’s the thing: no one has a crystal ball. But there are a few key indicators to watch. First, any concrete developments regarding the Gaza ceasefire. Second, any major shifts in the Ukraine conflict. Third, keep an eye on announcements from OPEC+ (the Organization of the Petroleum Exporting Countries and its allies), as they often adjust production levels to influence prices. According to the latest reports, OPEC+ is closely monitoring the global economic situation before making any further production cuts.

And finally, remember that energy security is a long-term game. India is investing heavily in renewable energy sources, which will gradually reduce its reliance on imported oil. But that transition will take time. In the meantime, understanding the factors that influence oil prices is crucial for making informed decisions.

FAQ | Decoding the Oil Price Puzzle

What if the Gaza ceasefire collapses?

If the ceasefire falls apart, expect increased volatility and potentially higher oil prices due to renewed fears of supply disruptions.

How much does the Indian government affect fuel prices?

The government influences prices through taxes and subsidies. Changes in these policies can either increase or decrease the price you pay at the pump. More insights on market trends here .

Are electric vehicles the answer to oil price volatility?

Electric vehicles can help reduce demand for oil, but widespread adoption will take time. They are part of the long-term solution, not a quick fix.

What is the role of U.S. oil production in impacting the global oil prices?

U.S. oil production is one of the crucial factors impacting global oil prices . Increased production in U.S. leads to increased supply, thus leading to lower prices.

How does the strength of the Indian rupee affect oil prices in India?

A weaker rupee makes crude oil imports more expensive, leading to higher fuel prices for Indian consumers.

In conclusion: The world of oil prices is a complex web of geopolitics, economics, and a dash of plain old uncertainty. The pause we’re seeing now could be temporary. Be informed, be prepared, and don’t let the headlines dictate your life. That’s the best any of us can do.