Alright, let’s talk PCE . You’ve probably heard it mentioned on the news or seen it scrolling across your favorite financial website. But, let’s be honest, do you really know what it is and, more importantly, why you should care? Here’s the thing: the Personal Consumption Expenditures (PCE) price index is a critical economic indicator, and understanding it can give you a serious edge in understanding the broader economy. I initially thought it was just another boring statistic, but then I realized…it’s the Fed’s favorite inflation gauge!

What Exactly Is the PCE? A No-Nonsense Explanation

So, what is the PCE index anyway? In simple terms, it measures the prices that people in the United States pay for goods and services. It’s like a giant shopping cart that tracks how much things cost, from your morning coffee to your monthly rent.

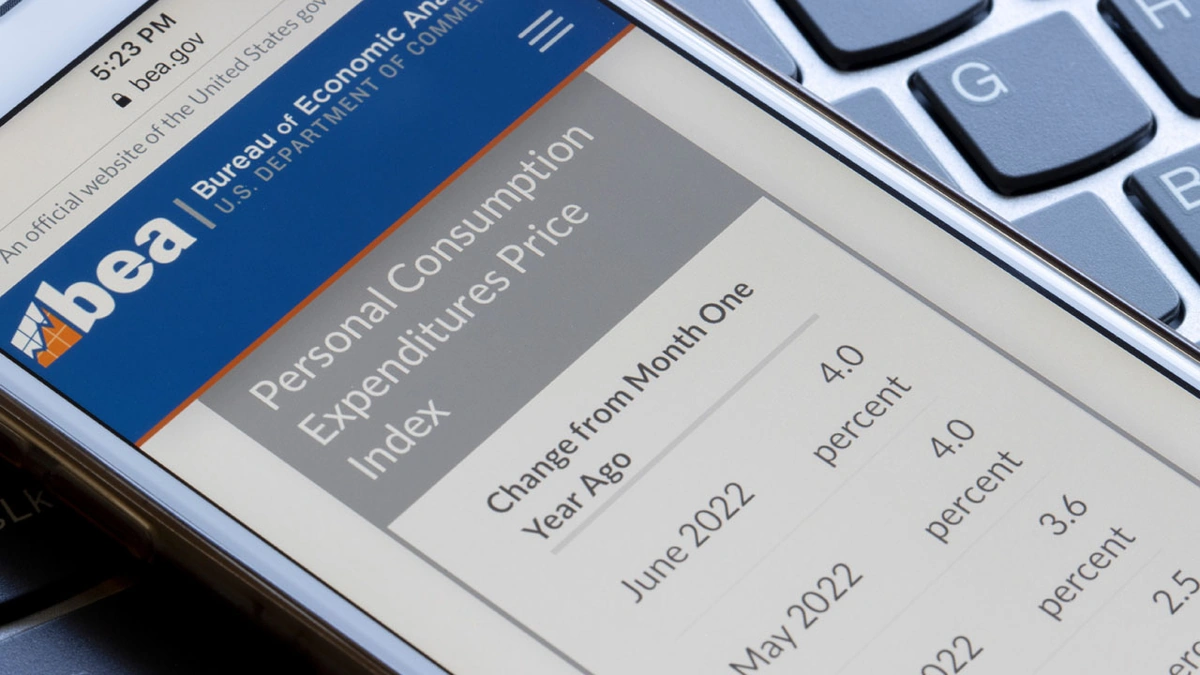

But here’s where it gets interesting. The Bureau of Economic Analysis (BEA) calculates the PCE, and they use a pretty comprehensive dataset. According to the BEA, the PCE inflation rate is derived from surveys of businesses, not consumers, which some economists believe makes it more accurate than the Consumer Price Index (CPI). In other words, it tells a story about what businesses are charging, not just what consumers are reporting they pay.

And, it’s not just a single number. The headline PCE includes everything, while the “core” PCE excludes volatile food and energy prices. This is important because the Federal Reserve (the Fed) focuses on the core PCE to get a clearer picture of underlying inflation trends . Check out the economic calendar for the latest release dates.

Why the Fed is Obsessed (and Why You Should Be Too)

Okay, so it measures prices. Big deal, right? Wrong. The Fed uses the core PCE as its primary gauge for inflation targeting . They have a target of 2% inflation, and they adjust monetary policy (like interest rates) to try to keep inflation around that level.

Think of it like this: the Fed is trying to drive a car (the economy), and the PCE is the speedometer telling them how fast they’re going (inflation). If inflation is too high, they hit the brakes (raise interest rates). If inflation is too low, they hit the gas (lower interest rates). Get it?

Now, the PCE report isn’t the only thing the Fed looks at, of course. They also consider things like employment data, economic growth, and global events. But the PCE is a crucial piece of the puzzle. So, paying attention to the monthly PCE data release can give you clues about what the Fed might do next. And that, my friend, can impact everything from your mortgage rates to your investment portfolio.

How the PCE Impacts Your Wallet | Real-World Examples

Let’s get down to brass tacks. How does all this mumbo jumbo actually affect you? Well, if the core PCE price index is rising rapidly, the Fed is likely to raise interest rates. That means:

- Mortgage rates go up, making it more expensive to buy a home.

- Credit card rates go up, making it more expensive to carry a balance.

- Business investment may slow down, potentially leading to slower job growth.

On the other hand, if the PCE is falling or staying below the Fed’s target, they might lower interest rates. That can:

- Lower borrowing costs for consumers and businesses.

- Stimulate economic growth.

- Potentially lead to higher inflation down the road.

I initially thought this was straightforward, but then I realized the complexities involved. The thing you absolutely must remember is this: The PCE is one of the indicators to understand what the Fed might do, and that has ripple effects throughout the economy.

Beyond the Headline | Digging Deeper into the PCE Data

Want to become a true PCE expert ? Here are a few tips for digging deeper:

- Pay attention to the components: The PCE report breaks down spending into different categories (goods vs. services, durable vs. non-durable goods). This can give you insights into which areas of the economy are experiencing the most inflation.

- Look at the revisions: The BEA often revises its PCE estimates as more data becomes available. So, don’t just focus on the initial release; keep an eye on the revisions as well.

- Compare it to other inflation measures: Don’t rely solely on the PCE. Look at other measures like the CPI and the Producer Price Index (PPI) to get a more complete picture.

According to the latest data releases, keeping an eye on trends in inflation expectations can provide a bit more insight into where things might be headed. Stay updated on the latest economic news .

Final Thoughts | The PCE is Your Economic Compass

So, there you have it. The PCE isn’t just another boring economic statistic. It’s a vital tool for understanding inflation trends , predicting the Fed’s next move, and making informed decisions about your money. By paying attention to the PCE, you can become a more savvy and informed participant in the economy.

FAQ | Your Burning PCE Questions Answered

What if I forgot where to find the monthly PCE release?

The BEA (Bureau of Economic Analysis) website is your best bet. Just Google “BEA PCE” and you’ll find it.

Is the PCE always released at the same time each month?

Generally, yes. It’s usually released towards the end of each month, covering the previous month’s data. But check the BEA’s release schedule to be sure.

What’s the difference between the PCE deflator and the PCE price index?

The PCE deflator is a broader measure that includes all goods and services in the GDP, while the PCE price index focuses specifically on household spending.

Why does the Fed prefer the core PCE over the headline PCE?

Because the core PCE excludes volatile food and energy prices, giving the Fed a clearer view of underlying inflation trends.

Where can I find historical PCE data?

The FRED (Federal Reserve Economic Data) database is a great resource for historical economic data, including the PCE.