Okay, let’s be real. Another economic report? Your eyes probably glaze over faster than a Krispy Kreme donut. But stick with me, because the PCE report that just dropped today isn’t just another set of numbers. It’s a sneak peek into the Federal Reserve’s playbook, and it directly impacts your wallet. Here’s why you should care, and I mean really care.

The PCE Deep Dive | Beyond the Headlines

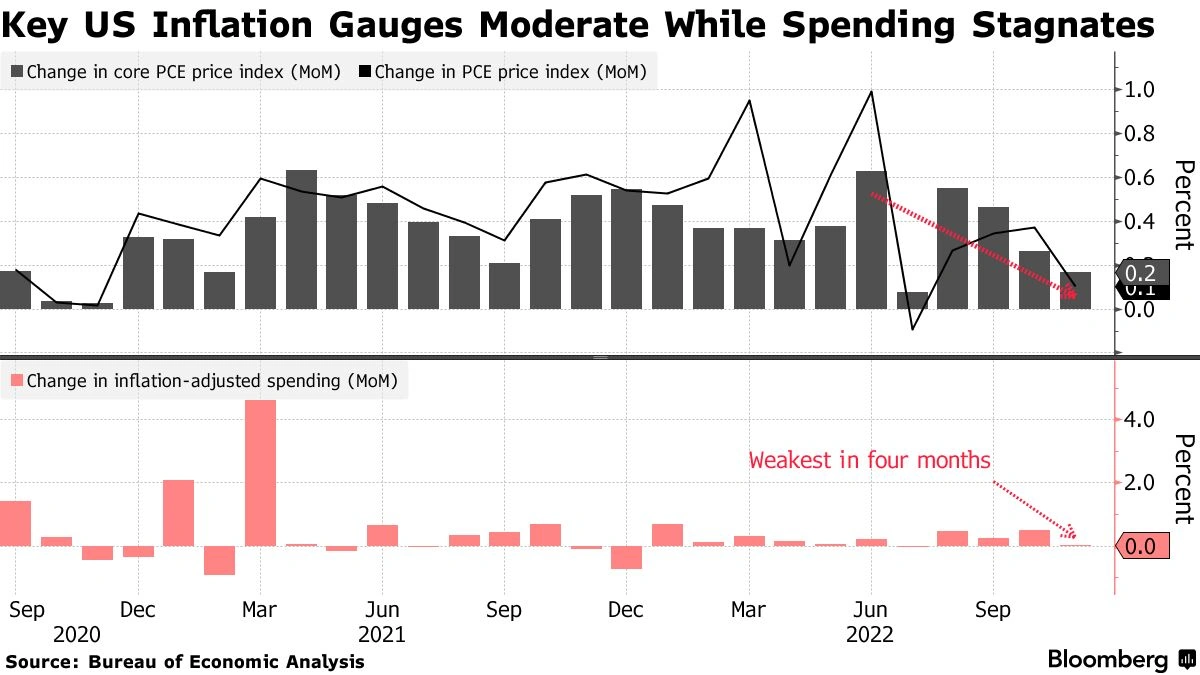

First things first, what is the PCE report ? It stands for Personal Consumption Expenditures Price Index. Sounds boring, I know. But it’s basically a measure of what people are spending money on. The Fed uses it (specifically the core PCE, which excludes volatile food and energy prices) as its primary gauge of inflation. And inflation, my friends, dictates interest rates, which then ripple through everything from your mortgage to your credit card APR.

The latest report? Well, let’s just say it’s got everyone doing a double-take. Was the inflation rate higher than expected? Lower? The answer matters. The trend of core inflation is what we’re really looking at here. Economists are closely watching this to see if inflation is truly cooling down or if it’s proving to be more stubborn than initially anticipated.

Decoding the Data | Is Inflation Really Cooling?

So, what does the latest PCE data tell us? The devil’s in the details, and this is where it gets interesting. If the report shows inflation is still running hot, that’s a green light for the Fed to keep those interest rates high. Think of it like this: higher rates are the Fed’s way of slamming on the brakes to slow down the economy and curb spending. But that also means borrowing money gets more expensive.

But, but , if the data suggests inflation is finally easing, the Fed might start considering easing up on the rate hikes. And that’s when things get exciting. Lower rates could provide a boost to the economy, making it cheaper to borrow and potentially giving a little breathing room to consumers. It’s a delicate balancing act, and the latest PCE report is a key piece of the puzzle.

What fascinates me is how nuanced this all is. It’s not just about the headline number. It’s about the underlying trends, the specific sectors driving inflation, and how the Fed interprets all of it.

Why the Core PCE Matters to You (And Your Investments)

Okay, enough economics jargon. Let’s talk about you. Why should you, a real person living in the real world, care about this? Simple. It impacts your purchasing power. If inflation is high, your dollar doesn’t stretch as far. Groceries cost more. Gas prices go up. Basically, everything gets more expensive.

And it’s not just your day-to-day expenses. It also affects your investments. Stock market reactions to the PCE report can be swift and significant. A hotter-than-expected inflation reading can send stocks tumbling, while a cooler reading can provide a boost. Understanding the economic indicators in the report helps you make informed decisions about your portfolio. Consider economic forecasting to make better decisions with market volatility.

Did you know that NVDA premarketactivity can be influenced by these reports, which is why it’s important to check the numbers?

Taking Action | What to Do With This Information

So, you’ve digested the news. Now what? Here’s the thing: don’t panic. Economic reports are just snapshots in time. They don’t tell the whole story. But they do provide valuable clues. The one thing you absolutely must do is stay informed. Follow reputable financial news sources, and don’t get caught up in the hype.

Here’s what I would suggest. If you’re concerned about inflation, consider adjusting your budget to prioritize essential spending. Look for ways to cut back on discretionary expenses. And if you’re an investor, consider diversifying your portfolio to mitigate risk. And if you are trying to figure outkodiak ai, wait until after the report to think about investment. Remember, it’s always a good time to consult with a financial advisor to create a personalized plan that aligns with your goals.

PCE Report | Long-Term Implications and the Fed’s Next Move

Looking ahead, the PCE report will continue to be a crucial factor in shaping the Fed’s monetary policy. The central bank is walking a tightrope, trying to tame inflation without triggering a recession. The next few months will be critical in determining whether they can successfully pull it off.

Let me rephrase that for clarity. The Fed wants to slow things down without breaking anything. A soft landing, as they say. Whether the latest economic data will allow them to make the right decision, will be revealed in the next few reports.

FAQ | Decoding the PCE Report

What exactly does the PCE measure?

It measures the prices of goods and services purchased by individuals.

Why is the core PCE so important?

Because it excludes volatile food and energy prices, giving a clearer picture of underlying inflation trends.

How does the PCE report affect interest rates?

The Fed uses it to gauge inflation and make decisions about raising or lowering interest rates.

What if the PCE report shows higher-than-expected inflation?

The Fed is more likely to keep interest rates high, potentially slowing down the economy.

What if the PCE report shows lower-than-expected inflation?

The Fed might consider easing up on rate hikes, potentially boosting the economy.

Where can I find the PCE report?

The Bureau of Economic Analysis (BEA) releases the report on its website.

The real takeaway? The PCE report is not just a bunch of numbers. It’s a window into the economy and the Fed’s thinking. By understanding its implications, you can make more informed decisions about your finances and investments. And let’s be honest, who doesn’t want a little more control over their financial future?