PepsiCo just dropped its Q3 report, and while the headlines scream “robust sales,” there’s a little more to the story than meets the eye – especially if you’re watching the market closely from India. Yes, globally, they’re doing quite well. But North American demand softening ? That’s a wrinkle we need to iron out. So, what’s really going on behind those bubbly numbers, and why should Indian investors or business enthusiasts care? Let’s dive in.

The Global Picture | A Sweet Symphony of Snacks and Sodas

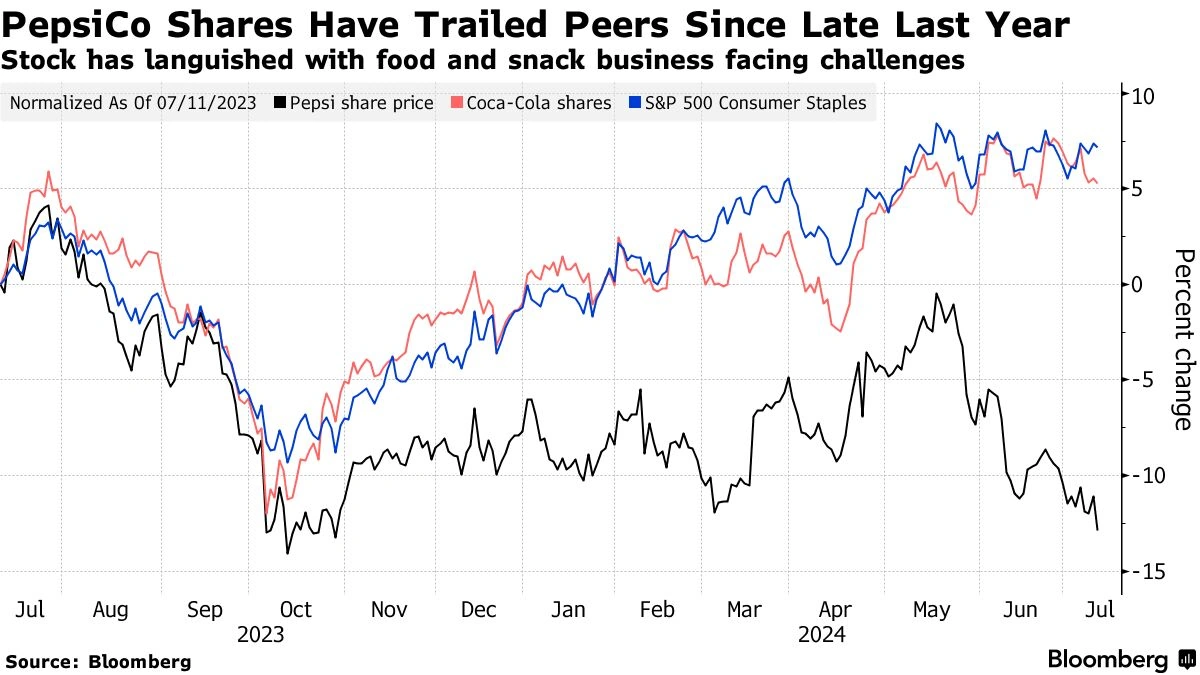

First, the topline: PepsiCo’s overall performance is undeniably strong. We’re talking about a global behemoth that’s successfully navigating a pretty turbulent economic landscape. But, here’s the thing: averages can be deceiving. While emerging markets are singing a happy tune, the tune in North America – PepsiCo’s biggest market – is a bit more… subdued. This geographical divergence is critical to understanding the full picture, and it’s where the “why” starts to get really interesting.

North America | A Demand Dip or a Passing Fizz?

Let’s be honest – the phrase ” demand softening ” isn’t exactly music to investors’ ears. But before we start panicking, let’s break it down. Is this a temporary blip caused by, say, changing consumer preferences (hello, health trends!) or inflationary pressures squeezing household budgets? Or is it a sign of a deeper, more structural shift in the market? That’s the million-dollar question, isn’t it? My initial thought was simply that consumers are more health conscious these days, but it’s likely a more complex mixture of multiple factors. In India, we’re seeing similar trends, with consumers becoming increasingly discerning about what they eat and drink. Keeping an eye on these trends in developed markets can give Indian businesses a head start in adapting to evolving consumer demands here.

The India Angle | Opportunities and Lessons

Here’s where it gets really relevant for us in India. PepsiCo’s global strategy offers a fascinating case study in how multinational corporations adapt to diverse market conditions. India, with its burgeoning middle class and youthful population, represents a massive growth opportunity for companies like PepsiCo. But it’s not just about replicating the North American playbook. It’s about understanding local tastes, preferences, and affordability.

The trends that are causing “ demand softening ” in the US may present new opportunities in India. Perhaps a pivot toward healthier alternatives, or localized flavors. These are all viable strategic decisions for companies hoping to gain ground in the Indian markets. And speaking of market shifts, the rise of local players in the beverage and snack industries is also something to watch. They often have a better understanding of local nuances and can be more agile in responding to changing consumer tastes. The competitive landscape is heating up!

Inflation, Innovation, and the Indian Consumer

Okay, let’s talk about inflation – the elephant in the room, globally. Rising prices are impacting consumer behavior everywhere, and India is no exception. Consumers are becoming more price-sensitive, and that’s forcing companies to get creative. One way PepsiCo is combating the economic climate is through aggressive innovation to get ahead of the curve. What fascinates me is how PepsiCo balances maintaining profitability with offering affordable options. Are they shrinking package sizes? Introducing value-priced products? Leveraging local sourcing to reduce costs? These are all tactics that Indian companies can learn from, especially in a market where price is often a key deciding factor. And let’s not forget the power of branding and marketing. Creating a strong brand image that resonates with Indian consumers can help companies command a premium, even in a price-sensitive market. Brand loyalty is key.

Another element to watch out for is supply chain disruptions. PepsiCo has had to adeptly manage a variety of challenges to ensure the delivery of its products, and businesses in India will likely face similar challenges. Understanding the strategies PepsiCo used to mitigate these disruptions is invaluable for Indian companies.

But, the game isn’t all about challenges. In India, you’ve got a massive population that’s increasingly tech-savvy. This opens up tons of opportunities for digital marketing, e-commerce, and direct-to-consumer sales. PepsiCo’s global digital strategy – how they’re using social media, online advertising, and data analytics – offers valuable insights for Indian businesses looking to tap into the power of the internet. Let me rephrase that for clarity: Digital is no longer optional; it’s essential for reaching and engaging with today’s Indian consumer. The consumer base is increasingly online!

Conclusion | Beyond the Headlines

So, PepsiCo’s Q3 report is more than just a bunch of numbers. It’s a window into the complex dynamics of the global consumer market. The North American “demand softening” isn’t necessarily a doomsday scenario, but it’s a signal that companies need to be agile, innovative, and deeply attuned to local market conditions. For Indian businesses, it’s a chance to learn from a global giant, adapt those lessons to the unique Indian context, and chart a course for sustainable growth. This is about more than just PepsiCo sales; it’s about the future of consumer businesses in a rapidly changing world. It’s about seeing the world through the lens of a multinational corporation and leveraging that vision to build something even better. What truly fascinates me is how trends in the US can predict trends in India, and vice versa.

FAQ

What exactly does “demand softening” mean?

It means that the rate at which people are buying PepsiCo’s products in North America has slowed down compared to previous periods. It doesn’t necessarily mean sales are declining, but the growth isn’t as strong.

Is PepsiCo doing badly overall?

No, not at all! Globally, PepsiCo is performing well. The “demand softening” is primarily in North America.

How does inflation affect PepsiCo’s sales?

Inflation can lead consumers to cut back on discretionary spending, including things like snacks and beverages. It also increases PepsiCo’s costs for ingredients and packaging, which can lead to higher prices.

What are some strategies PepsiCo might use to counter the demand softening?

They might introduce new products, offer promotions and discounts, focus on value-priced options, or invest more in marketing to maintain brand loyalty.

How can Indian businesses learn from this situation?

By understanding the factors driving the demand softening in North America, Indian businesses can anticipate similar trends in India and develop strategies to mitigate their impact. This includes focusing on affordability, innovation, and digital marketing.

What kind of consumer behavior changes can be expected in the coming years?

Consumers are looking for healthier options and environmentally conscious choices when shopping for snacks and beverages.