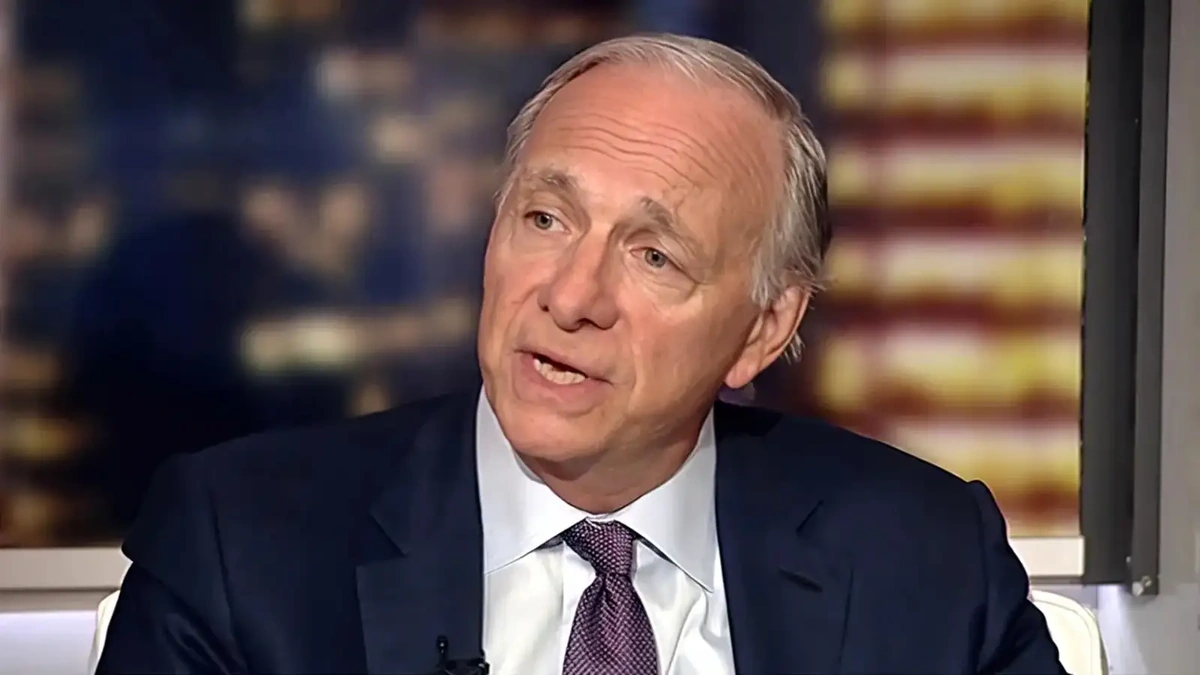

Ray Dalio, the billionaire founder of Bridgewater Associates, isn’t exactly known for sugarcoating things. But his recent warnings about the current global landscape – financial instability, technological disruption, and civil strife – have truly sent ripples across the investment world. He’s drawing parallels to the pre-World War II era, a time of intense geopolitical and economic upheaval. So, what exactly is Dalio seeing that has him so concerned, and more importantly, what does it mean for you and me, especially here in India?

Let’s be honest, global finance can feel incredibly distant. It’s all numbers and jargon, right? But Ray Dalio’s analysis isn’t just about Wall Street; it’s about Main Street, and it affects everyone from the tech entrepreneur in Bangalore to the farmer in Punjab. And that’s the angle we’re going to dig into – why this matters, and what we can potentially do about it.

The Perfect Storm | Dalio’s Key Concerns

Dalio’s argument isn’t based on a single factor, but rather a confluence of events – a perfect storm, if you will. He points to several key areas:

- Financial Pressures: He highlights the unsustainable levels of debt held by many countries, coupled with rising inflation and interest rates. This creates a scenario where governments and businesses struggle to repay their debts, leading to potential defaults and economic slowdown. Debt burden is not a new thing, but the scale of it combined with other factors makes it significant.

- Technological Disruption: The rapid advancement of artificial intelligence (AI) and automation is displacing workers in various industries. While technology creates new opportunities, the transition can be painful, leading to increased inequality and social unrest. And let’s not forget the digital divide within India itself; the opportunities are not evenly distributed.

- Civil and International Conflict: Dalio sees rising tensions between nations and within countries, fueled by political polarization and economic inequality. This can manifest in trade wars, geopolitical conflicts, and even civil unrest.

Now, here’s the thing: none of these factors are entirely new. We’ve seen financial crises, technological advancements, and geopolitical tensions before. But Dalio’s point is that they are all converging simultaneously, creating a situation that is particularly dangerous. He uses the pre-WWII era as an analogy because that period also saw a similar combination of economic hardship, technological change, and rising nationalism.

The India Angle | Why Should We Care?

So, why should someone in India, focused on their daily life, be concerned about global economic instability ? Because India is deeply interconnected with the global economy. A slowdown in global growth can impact India’s exports, investment flows, and overall economic prospects. Think about it – Indian IT companies rely heavily on clients in the US and Europe. A recession in those regions would inevitably affect the IT sector and the millions of people it employs. Furthermore, rising inflation and interest rates globally can put pressure on the Indian Rupee and make it more expensive for Indian companies to borrow money.

But it’s not just about economics. The geopolitical tensions Dalio warns about can also have implications for India’s security and foreign policy. As a major player in the region, India needs to navigate a complex web of international relationships and be prepared for potential disruptions to global trade and supply chains.

What fascinates me is how these global trends intersect with India’s own unique challenges. We’re dealing with issues like income inequality, unemployment, and social divisions that could be exacerbated by the forces Dalio describes. It’s crucial to address these challenges head-on to mitigate the potential negative impacts.

Navigating the Storm | What Can Be Done?

Okay, so the picture Dalio paints isn’t exactly rosy. But that doesn’t mean we’re helpless. Here are some things that individuals and policymakers can do to navigate the coming storm:

- Financial Prudence: For individuals, this means being mindful of debt levels, saving for the future, and diversifying investments. Don’t put all your eggs in one basket, as they say.

- Skills Development: Investing in education and skills development is crucial to adapt to the changing job market. Focus on acquiring skills that are in demand, such as data science, AI, and digital marketing.

- Policy Reforms: Governments need to implement policies that promote inclusive growth, reduce inequality, and strengthen social safety nets. This includes investing in infrastructure, education, and healthcare.

- International Cooperation: Addressing global challenges requires international cooperation and coordination. Countries need to work together to resolve trade disputes, address climate change, and promote peace and security.

Moreover, investment strategies should be cautiously planned according to the changing market situations. Understanding the economic indicators and geopolitical risks is very important.

Ray Dalio’s Perspective on Civil Unrest

Dalio’s concern extends beyond financial woes and technological shifts to the very fabric of society. He highlights the increasing polarization and division within countries, leading to civil unrest. This manifests in protests, social movements, and even political violence. It’s driven by a number of factors, including economic inequality, cultural clashes, and a loss of trust in institutions.

The implications of civil unrest are far-reaching. It can disrupt economic activity, undermine social cohesion, and even threaten political stability. While India has a strong democratic tradition, it’s not immune to these challenges. We’ve seen protests and social movements in recent years, reflecting underlying tensions and grievances. A strong sense of national identity and respect for diverse opinions becomes more vital than ever.

In light of this, it’s important to promote dialogue and understanding across different groups. This means listening to different perspectives, finding common ground, and working together to address shared challenges. And it’s about having some empathy. Let’s be honest, it is not easy when you have so much noise all around.

What Can India Do To Prepare for Financial Turmoil?

India, with its large population and growing economy, can take specific steps to buffer itself from potential financial turmoil. Strengthening its domestic economy through infrastructure development, promoting local manufacturing (Make in India initiative), and encouraging entrepreneurship can reduce reliance on external factors. Prudent fiscal policies, including managing debt levels and diversifying foreign exchange reserves, are crucial. Also, investing in human capital by improving education and healthcare will enhance the country’s resilience.

By focusing on internal strengths and promoting sustainable development, India can weather the storm and emerge stronger.

The Bottom Line

Ray Dalio’s warnings are a wake-up call. They remind us that the world is a complex and interconnected place, and that events far away can have a significant impact on our lives. By understanding the risks and taking proactive steps, we can navigate the challenges ahead and build a more resilient future. It’s not about panicking, but about being prepared and making informed decisions. The key is to stay informed, stay adaptable, and stay engaged.

What India needs is, in my humble opinion, to invest in sustainability for the long-run. Geopolitical situations will arise and pass, what needs to stay is the solid foundation to deal with them.

FAQ

What exactly is Ray Dalio predicting?

Ray Dalio is warning about a confluence of financial, technological, and civil tensions that he sees as mirroring the pre-World War II era, suggesting potential economic and social upheaval.

How could global financial instability affect me in India?

A global slowdown can impact India’s exports, investment, and currency value, potentially affecting jobs and the cost of goods.

What can I do to protect myself financially?

Be mindful of debt, save regularly, and diversify your investments. Consider learning new skills to adapt to the changing job market.

Where can I find more about Ray Dalio’s analysis ?

You can find Ray Dalio’s writings and interviews on Bridgewater Associates’ website and various financial news outlets.

What are the main drivers of civil unrest that Dalio mentions?

Dalio points to economic inequality, cultural clashes, and a decline in trust in institutions as key factors fueling civil unrest.

Is India particularly vulnerable to these global trends?

Like any country deeply connected to the global economy, India faces risks. However, its large domestic market and growing economy provide some resilience, provided that income inequalities are properly addressed.