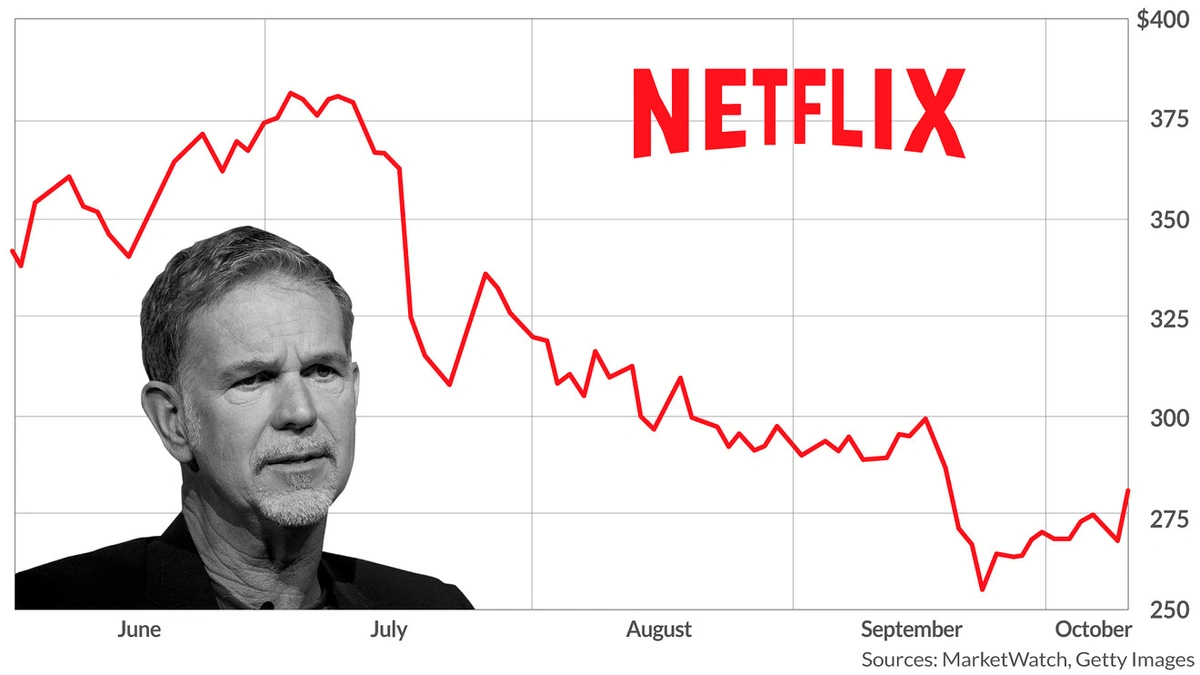

Okay, let’s be honest, keeping up with the stock market can feel like watching a reality TV show – dramatic twists, unexpected turns, and sometimes, you’re just left scratching your head. And few stocks have provided more drama recently than < strong >Netflix (NFLX). But here’s the thing: it’s not just about the numbers going up or down. It’s about why , and what it means for the future of entertainment.

Why Wall Street Is So Obsessed With Netflix’s Subscriber Numbers

So, why all the fuss about subscriber growth ? Well, for years, Netflix’s narrative was simple: acquire more subscribers, increase revenue, and dominate the streaming world. Wall Street bought into this, driving the < strong >Netflix stock priceto astronomical heights. But then, the growth started to slow. Suddenly, everyone was questioning the business model. I initially thought it was just a temporary blip, but then I realized it’s a deeper issue.

The saturation point is real. Not everyone in the world is going to subscribe to Netflix, and frankly, with so many streaming options – Disney Plus , HBO Max , Amazon Prime Video – people are getting choosy. And let’s not forget about cord-cutting . The streaming landscape is changing, which in turn, is having an impact on the < strong >Netflix share price. According to a recent report by Statista , Netflix has over 238 million subscribers worldwide as of Q3 2023. But the question is: can they keep growing that number at the same rate?

Beyond Subscribers | The Key Metrics That Really Matter

Here’s what fascinates me: Focusing solely on subscriber numbers is missing the bigger picture. There are other crucial metrics we need to consider. Average Revenue Per User (ARPU) , for example, tells us how much money Netflix is making from each subscriber. If ARPU is increasing, even with slower subscriber growth, that’s a good sign. And the introduction of ad-supported tiers is aimed squarely at boosting ARPU. It’s a balancing act, though. Raise prices too much, and you risk losing subscribers. As the folks over atThe Motley Foolare good at pointing out, it’s about finding the sweet spot.

Another key factor: content strategy . Are they creating shows and movies that people actually want to watch? Are they investing in the right genres? A common mistake I see people make is underestimating the power of local content. Think about the success of shows like “Squid Game” – it proved that global audiences are hungry for stories from different cultures. And that’s why Netflix is investing heavily in international productions. Not to mention their push into gaming – which could be a significant new revenue stream. But, is it enough to satisfy investors hungry for growth?

The Password Sharing Crackdown | Genius Move or PR Disaster?

Ah, the infamous password sharing crackdown. Netflix estimated that millions of households were using shared passwords, effectively watching for free. So, they decided to put an end to it. The move was met with outrage, with many users threatening to cancel their subscriptions. But, here’s the thing: It seems to be working. While there was initial churn, Netflix is now reporting an increase in subscribers, likely due to people either paying for their own accounts or adding extra members to their existing ones.

But, there’s a risk. Netflix needs to tread carefully. Annoy too many users, and they’ll simply switch to another service. And that’s why customer retention is so important. It’s not just about acquiring new subscribers, it’s about keeping the ones you already have. Click here to see what the experts are saying.

Looking Ahead: What’s Next for Netflix and Its Stock?

So, what’s the future of Netflix stock ? Honestly, it’s hard to say for sure. But, here’s what I’m watching for: continued growth in ARPU, success of their ad-supported tier, and smart investments in content. The streaming wars are far from over, and Netflix faces fierce competition. But, they have a massive head start and a proven track record.

One thing I think is absolutely critical: Transparency. Netflix needs to be more transparent with investors about their long-term strategy. They need to clearly articulate how they plan to navigate the changing landscape and continue to deliver value. The wild fluctuations in < strong >NFLX stockare a reflection of uncertainty. Reduce the uncertainty, and you’ll stabilize the stock. More information here.

FAQ About Netflix Stock

Will Netflix stock go up?

It’s impossible to say for sure, but analysts’ estimates vary widely. Keep an eye on subscriber growth, ARPU, and content performance.

Is Netflix a good long-term investment?

That depends on your risk tolerance and investment strategy. Netflix faces competition, but also has a strong brand and global reach.

What factors affect Netflix’s stock price?

Subscriber growth, competition from other streaming services, content costs, and overall market conditions all play a role.

How does the password sharing crackdown affect Netflix stock?

While initially unpopular, it appears to be driving new subscriptions and boosting revenue, which is generally positive for the stock.

What is Netflix’s business model?

Netflix primarily generates revenue through subscription fees, but is now expanding into ad-supported tiers.

Ultimately, the future of Netflix stock depends on the company’s ability to adapt and innovate in a rapidly evolving market. It’s a story that’s still being written, and I, for one, am excited to see what happens next.