Ever heard the term ” NJ Anchor Status ” tossed around and wondered what it actually means? It’s not as simple as a boat tied to a dock, trust me. It’s about property tax relief, and in a state like New Jersey – well, that’s something we all need to pay attention to. Let’s be honest, property taxes here can feel like a second mortgage. So, understanding programs like the Anchor Property Tax Relief Program is crucial.

I initially thought it was just another one of those confusing government programs. But digging deeper, I realized it’s designed to make living in New Jersey a little more affordable for homeowners and renters. It impacts a lot more people than you might think. Think of it as a small, but significant, tool in your financial toolkit.

Who Qualifies for This Lifeline?

Okay, so who gets a piece of this pie? The eligibility criteria are pretty specific, and it’s worth checking if you fit the bill. The program offers relief to New Jersey residents who owned or rented their primary residence as of October 1 of the tax year, and met certain income limits. You can review theofficial state websitefor all the details. But here’s the gist: homeowners with income up to $150,000 get the largest benefit, with smaller benefits for those earning up to $250,000. Renters also get a benefit, regardless of income.

A common mistake I see people make is assuming they don’t qualify because they think their income is too high. But with the tiered system, it’s always worth checking! And what fascinates me is that the program is designed to reach a broad spectrum of residents, from those just starting out to retirees on a fixed income.

Why Does NJ Have This Program Anyway?

So, why does New Jersey even have a program like ANCHOR ? Well, let’s rewind a bit. Property taxes in NJ are notoriously high among the highest in the nation. This puts a strain on residents, especially those with lower incomes or those on fixed incomes. The Anchor program is essentially a way for the state to offset some of that burden. It’s about making New Jersey more affordable and helping people stay in their homes.

But, and here’s the thing, it’s not just about individual relief. It’s also about the broader economy. When people can afford to stay in their homes and have a little extra money in their pockets, they’re more likely to spend it in the local economy. That stimulates growth and benefits everyone. I’ve seen similar programs work in other states , boosting local economies.

How Do You Actually Apply? (The Step-by-Step)

Alright, let’s get down to brass tacks. How do you actually apply for this thing? The application process is usually done online, and it’s relatively straightforward. First, you’ll need to gather some key information: your social security number, your property tax bill (if you’re a homeowner), and your income information. Then, you head over to the New Jersey Division of Taxation website.

Let me rephrase that for clarity – make sure you’re on the official state government website (nj.gov). There are scam sites out there that try to mimic the real thing. Once you’re on the right site, look for the Anchor program application . You’ll fill out the online form, providing all the required information. Double-check everything before you submit, because errors can cause delays. The one thing you absolutely must double-check is your bank routing and account numbers if you want to receive the Anchor benefit via direct deposit.

Common Pitfalls and How to Avoid Them

Okay, let’s talk about potential headaches. One common issue is missing the deadline. The state sets a specific deadline each year, and if you miss it, you’re out of luck. Mark your calendar and set a reminder. Another pitfall is providing incorrect information. As I said earlier, double-check everything. Even a small error can cause your application to be rejected. What fascinates me is how many applications get rejected due to easily avoidable mistakes.

And here’s another thing: make sure you understand the eligibility requirements. Don’t assume you qualify. Read the fine print. A common mistake I see people make is assuming that because they received the benefit last year, they’ll automatically get it again this year. Eligibility can change, so it’s always worth verifying. If you’re dealing with complex situations like trusts or inherited properties, it’s always wise to consult with a tax professional or seek guidance from the Division of Taxation.

Anchor Program Impact on Property Taxes in NJ

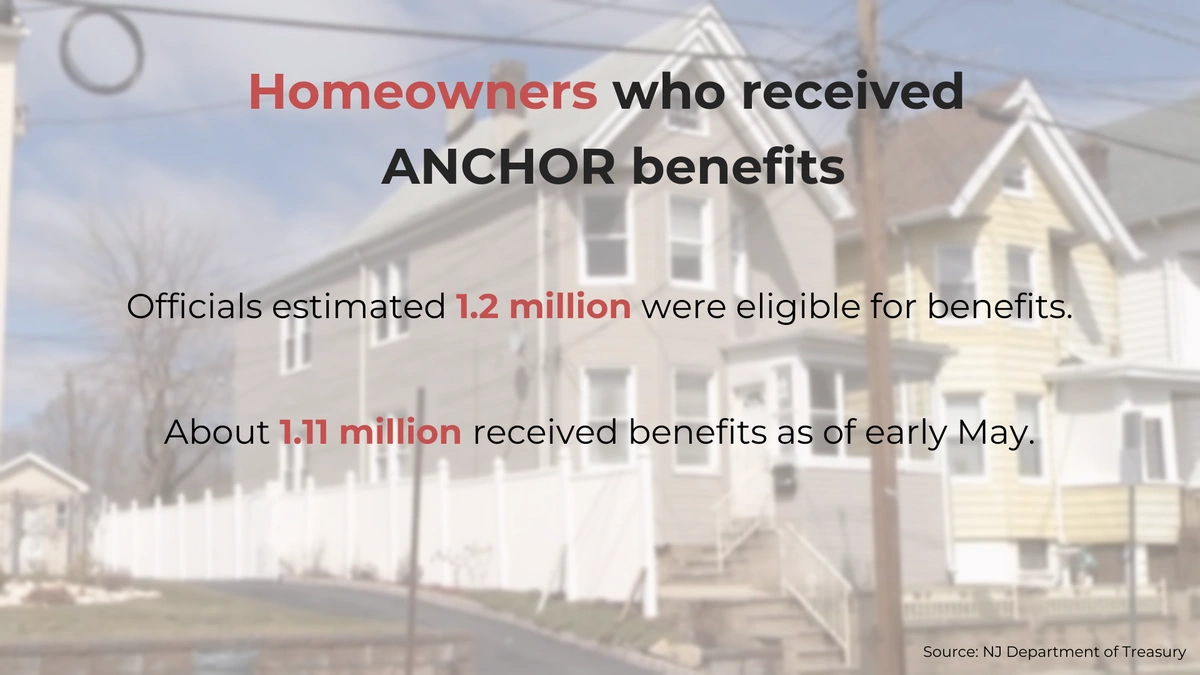

Let’s zoom out and look at the bigger picture. How does the Anchor program impact property taxes in NJ overall? While it provides direct relief to individual homeowners and renters, its broader impact on the overall property tax system is more complex. The Anchor program helps to offset some of the burden, it doesn’t fundamentally change the underlying system.

NJ’s reliance on local property taxes to fund schools and municipal services, as well as eligibility requirements, means the program impact on long-term issues can be limited. However, the direct financial relief provided each year to eligible residents, does help improve their quality of life.

FAQ | Your Burning Questions Answered

Frequently Asked Questions About Anchor Program

What if I forgot my application number?

Contact the NJ Division of Taxation. They can help you retrieve your application number.

Can I apply if I moved to NJ in November?

Unfortunately, no. You must have been a resident as of October 1 of the tax year.

What documents do I need to apply?

You’ll need your social security number, property tax bill (if you’re a homeowner), and income information.

How long does it take to receive the benefit?

Processing times vary, but it typically takes several weeks to months after the application deadline.

So, the NJ Anchor program: it’s not a magic bullet, but it’s a real benefit that can make a difference. Understanding how it works, who’s eligible, and how to apply is crucial for anyone living in the Garden State. It’s just one piece of the puzzle when it comes to managing your finances in a state known for its high cost of living. And honestly? Every little bit helps.