Okay, let’s be real. The internet’s buzzing about an inflation refund check , and you’re probably wondering if it’s legit. The truth is, there’s no nationwide, official “inflation refund check” coming from the federal government. But here’s the thing: individual states have been exploring ways to provide tax rebates , stimulus payments , or similar relief measures to their residents to combat the effects of inflation. I initially thought this was just another internet rumor, but then I realized that a few states actually did issue some payments in response to the rising costs of living. This is where it gets interesting…

Why Are States Considering These Payments? (The Real Story)

So, why are some states even thinking about sending out checks? It boils down to a few things. Firstly, many states are sitting on surprisingly large budget surpluses due to better-than-expected tax revenues. And what drives tax revenues? Increased spending! And what makes people spend? Stimulus checks and tax rebates! So, it’s kind of a self-perpetuating thing. Secondly, elected officials want to be seen as doing something to help their constituents deal with the pinch of high inflation . It’s good politics, plain and simple. Think of it as a localized effort to manage economic stimulus . This could involve various approaches, from direct payments to property tax relief .

But, (and this is a big but), these initiatives are state-specific. What fascinates me is the varying approaches states are taking. Some might opt for direct checks, while others might choose to cut sales taxes on specific items or offer tax credits. The key takeaway? You have to look at what’s happening in your state to see if you’re eligible for any kind of relief. Understanding the intricacies of these state tax rebates is crucial, so let’s dive deeper.

How to Find Out If Your State is Offering Relief

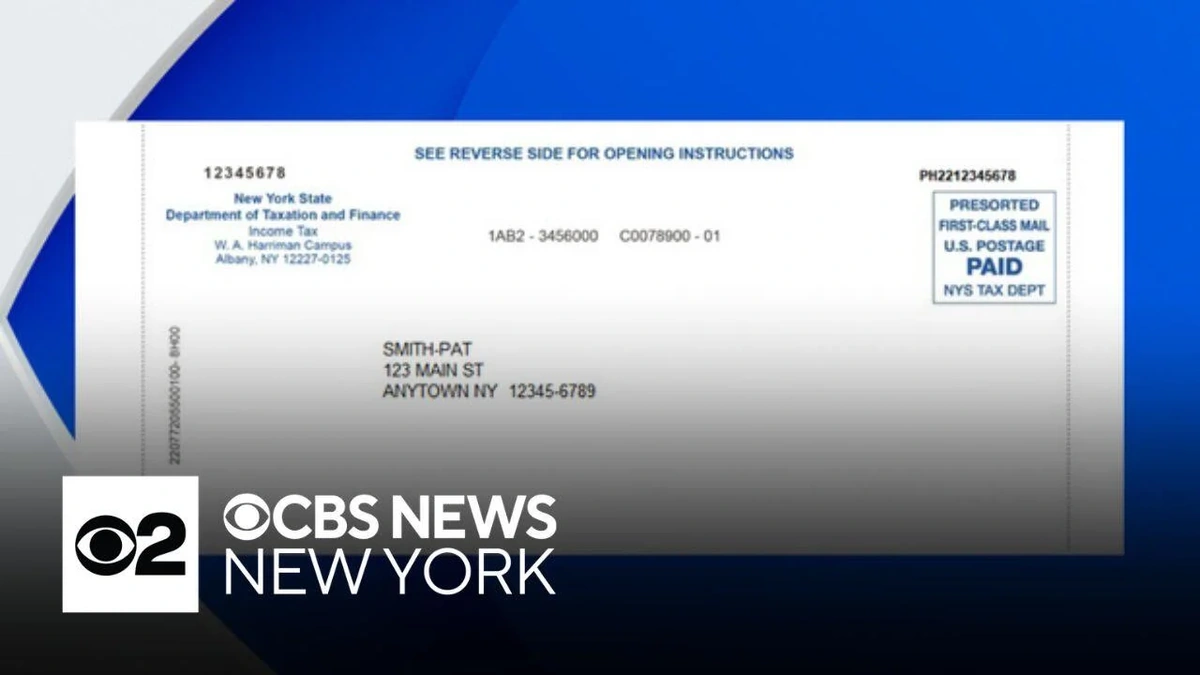

Alright, here’s the “how-to” part. The easiest way to find out if your state is offering any kind of financial assistance related to inflation is to head straight to your state’s official government website. Look for the Department of Revenue or Department of Finance. These sites usually have sections dedicated to tax information and any special programs that are being offered. A common mistake I see people make is relying on social media rumors – don’t do that! Go straight to the source. Another strategy is to search Google using specific search terms like “[Your State] inflation relief” or “[Your State] tax rebate 2024″. Make sure the sources you’re looking at are trustworthy (official government websites, reputable news organizations). And remember, programs and eligibility requirements can change, so double-check the dates of any information you find. Also keep in mind that some checks may be linked to eligibility requirements for programs such as social security .

The Potential Impact of Inflation Relief Programs

So, what’s the bigger picture here? Do these state-level inflation relief programs actually make a difference? That’s a complicated question. On one hand, any extra money in people’s pockets can help them afford necessities and ease financial stress. On the other hand, some economists worry that these programs could actually fuel inflation by increasing demand. There’s also the issue of equity – who benefits the most from these programs? Are they targeted towards low-income families who need the help the most, or do they primarily benefit higher-income earners? As per the Center on Budget and Policy Priorities, effective relief needs to be carefully targeted. There is a need for stimulus packages designed in a way that promotes economic growth without exacerbating inflation. Let me rephrase that for clarity: the effect depends a lot on the specifics of the program, like how much money is being distributed, who is getting it, and how it’s being funded.

What’s the Future of Inflation Relief?

Here’s the million-dollar question: will we see more states offering inflation relief in the future? It really depends on the state of the economy. If inflation remains high and states continue to have budget surpluses, it’s likely that more states will consider some form of relief. However, if the economy slows down and states start facing budget deficits, these programs could be scaled back or eliminated altogether. Keep an eye on economic news and developments in your state to stay informed. This is something that could be affected by federal interest rate policy , so there’s a lot of potential for policy shifts to take place. Navigating these economic indicators is going to be crucial.

One thing I want to stress is that even if your state isn’t offering a direct inflation refund check , there may be other programs available to help you manage your finances. Look into things like food assistance programs, rental assistance, and energy assistance programs. These programs can provide valuable support during times of economic hardship. Also consider investing in resources to learn more about growing your personal income.

FAQ About Potential Inflation Relief

Frequently Asked Questions

Will the federal government issue an inflation refund check?

As of right now, there are no plans for a nationwide federal stimulus check to address inflation. Any relief is likely to come from individual states.

How do I find out if my state is offering inflation relief?

Check your state’s official government website, specifically the Department of Revenue or Department of Finance.

What if I’m not eligible for a direct payment?

Look into other assistance programs like food assistance, rental assistance, and energy assistance.

Could these relief programs actually make inflation worse?

Some economists worry that they could increase demand and fuel inflation, but the impact depends on the specifics of the program.

Are there other ways to manage high costs?

Yes, explore ways to reduce your spending, increase your income, and take advantage of available resources. Consider contacting a financial advisor.

Here’s the final insight: Don’t blindly trust everything you see online. Do your research, go to the official sources, and understand the details of any potential relief programs. Your financial well-being depends on it.