Okay, let’s talk about something that hits everyone’s wallet – oil prices . You see the headline: Oil Prices Drop Following the Israel-Hamas Gaza Agreement. Great news, right? Maybe. But here’s the thing: the oil market is way more complex than just one headline. We need to unpack why this drop happened, what it actually means for you in India, and whether it’s a blip or a lasting trend. What fascinates me is how interconnected global events are – a conflict thousands of miles away directly affects how much you pay at the pump. Let’s dive in.

The Immediate Reaction | Geopolitics and Market Sentiment

The initial drop in crude oil prices following the reported agreement is largely a reaction to perceived de-escalation. Here’s why: the market hates uncertainty. Big time. Geopolitical instability, especially in a region as crucial to oil supply as the Middle East, sends shivers down the spines of traders. The Israel-Hamas conflict had initially sent oil prices soaring due to fears of wider regional disruption. But, with the agreement, the immediate threat of a broader conflict – one that could directly impact major oil producers – lessened. This is a classic case of “risk premium” being priced out of the market.

Think of it like this: imagine you’re buying insurance. If there’s a hurricane brewing, your premium goes up. But if the storm veers off course, your premium drops. Same principle here. This initial price correction reflects the market’s reassessment of the risk. And, the trading community factors in real-time data from resources such asthe Energy Information Administration.

But…and this is a big ‘but’… this is only part of the story. I initially thought this was straightforward, but then I realized we needed to look deeper.

Digging Deeper | Beyond the Headlines

Here’s where it gets interesting. Agreements can be fragile. The situation in the region is incredibly fluid, and any number of factors could reignite tensions. A key factor influencing global oil markets in situations like this is sentiment. Are traders truly convinced this agreement will hold? Are there underlying issues that haven’t been addressed? A common mistake I see people make is assuming that an initial market reaction represents the whole picture. It doesn’t.

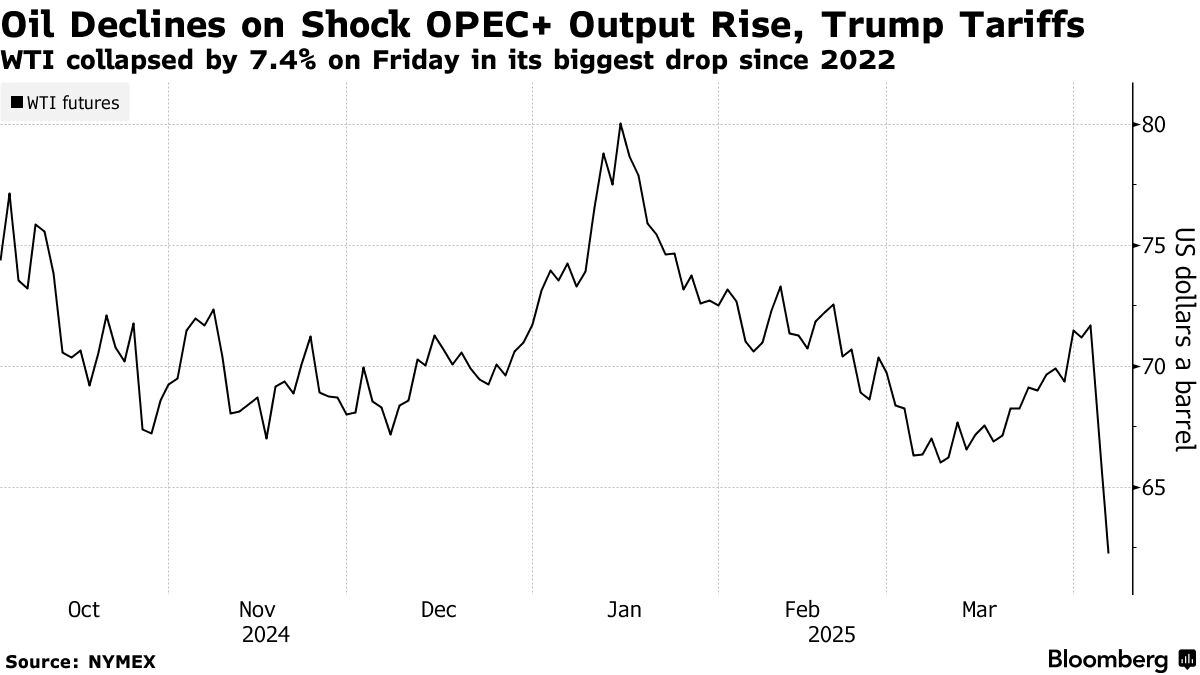

Moreover, the supply side of the equation remains crucial. OPEC+ production cuts, decisions by individual countries like Saudi Arabia (a major player in the oil game), and even weather events that disrupt production can all have a significant impact on prices. The internal link can be found here: Munich . So, while the agreement provided some initial relief, the underlying fundamentals of supply and demand haven’t fundamentally changed.

The Impact on India | A Delicate Balance

For India, a drop in international oil prices is generally good news. We’re a major importer of crude oil, so lower prices translate to a lower import bill, reduced inflationary pressures, and potentially lower fuel prices for consumers. But, and this is significant, the benefit isn’t always immediate or fully realized. Several factors mediate the impact: currency exchange rates (a weaker rupee can offset some of the price drop), government taxes and subsidies on fuel, and the pricing policies of oil marketing companies. I’ve seen it time and again: a drop in global prices doesn’t always translate to an equivalent drop at your local petrol pump.

Moreover, the long-term impact needs to be considered. A sustained period of lower oil prices could impact investment in renewable energy sources, which is a crucial part of India’s long-term energy security strategy. The other internal link can be found here: National Guard Chicago 7 . India is trying to balance the immediate benefits of cheaper fuel costs with the long-term need for a sustainable energy future.

What This Means For Your Wallet (and What To Watch For)

Let’s be honest, what you really want to know is: will petrol prices go down? The answer, as always, is…it depends. Keep an eye on these factors:

- The stability of the Israel-Hamas agreement: Any signs of renewed conflict could send prices back up.

- OPEC+ decisions: Watch for announcements regarding production levels.

- The Rupee-Dollar exchange rate: A weaker rupee will diminish the benefits of lower oil prices.

- Government policy: Changes in taxes or subsidies on fuel can significantly impact retail prices.

Here’s the thing: don’t expect miracles. While the initial drop is encouraging, the factors listed above will determine the ultimate impact on your pocketbook. Be prepared for fluctuations, and don’t base your financial decisions solely on short-term price fluctuations .

Long-Term Implications and Alternative Energy

What fascinates me is the long game. Even if this particular agreement holds and oil prices remain relatively stable, the world is inexorably moving towards alternative energy sources. Electric vehicles (EVs), solar power, and other renewables are becoming increasingly competitive. The energy market volatility we’re seeing now underscores the importance of diversifying our energy sources and reducing our dependence on fossil fuels. The long-term trend is clear: renewables are the future. India is investing heavily in this transition, and for good reason. According to data published byIRENA, solar energy is becoming increasingly cost-effective.

FAQ | Oil Price Drop Edition

Frequently Asked Questions

Will petrol prices in India drop immediately?

Not necessarily. While a drop in crude oil prices is a positive sign, the actual impact on retail prices depends on factors like the rupee-dollar exchange rate, government taxes, and the pricing policies of oil companies.

How does the Israel-Hamas agreement affect oil prices?

The agreement led to an initial drop in prices due to reduced fears of a wider regional conflict that could disrupt oil supplies.

What is OPEC+ and why does it matter?

OPEC+ is a group of oil-producing nations that coordinate their production policies. Their decisions can significantly impact global oil supply and, consequently, prices.

Should I buy an electric vehicle (EV) now?

That depends on your individual circumstances. EVs are becoming more affordable and practical, but factors like charging infrastructure and range anxiety still need to be considered.

What other geopolitical events can affect oil prices?

Any event that threatens oil supply or increases uncertainty in the market can impact prices. This includes conflicts, political instability, and even natural disasters.

How can I stay updated on oil price trends?

Follow reputable financial news sources and energy market analysts.

So, there you have it. The drop in oil prices is a welcome development, but it’s crucial to understand the underlying factors and not get carried away by short-term fluctuations. The global energy landscape is constantly evolving, and staying informed is the best way to navigate it. The future will require a deep understanding of global crude oil .