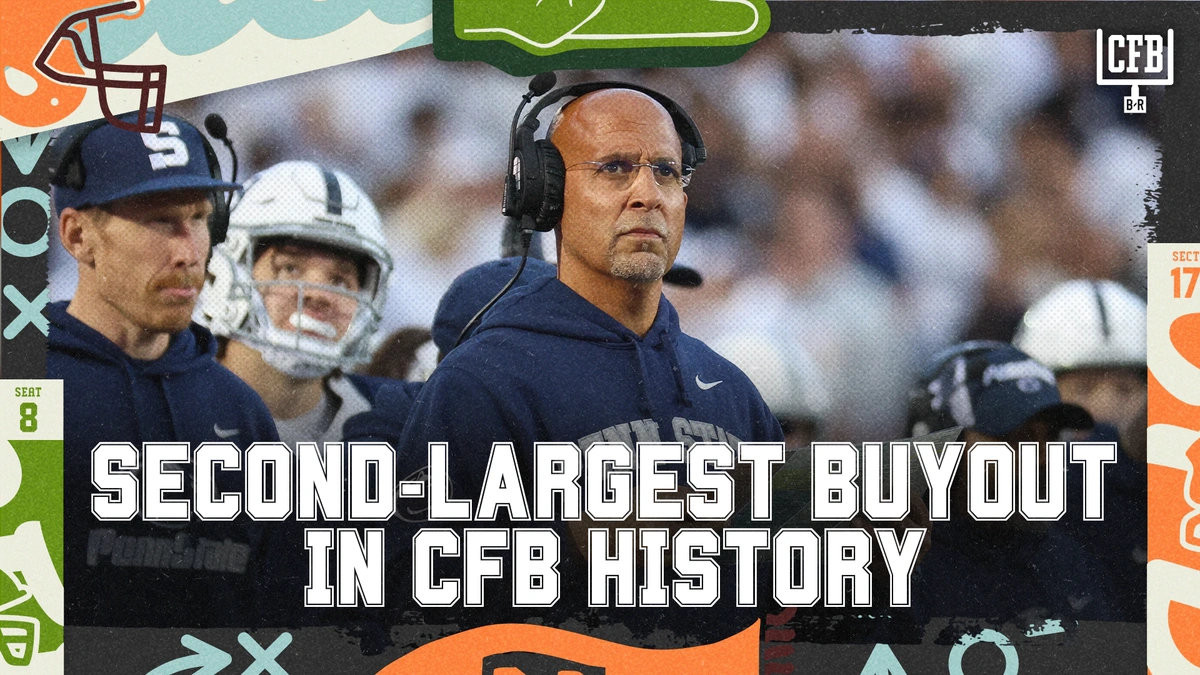

Okay, let’s be real. When you hear about a coach buyout, your first thought probably isn’t, “Wow, I wonder how much that costs per day?” But that’s exactly what’s happening with Penn State and James Franklin. And trust me, the numbers are eye-watering. This isn’t just about football; it’s a masterclass in the business side of college sports and the potential pitfalls of long-term contracts.

The Staggering Sum | Breaking Down the James Franklin Buyout

Here’s the thing: coaching contracts are often structured in ways that heavily favor the coach, especially if they’re successful. A buyout clause is essentially a pre-agreed-upon amount the university has to pay if they decide to terminate the contract early. It’s like saying, “We believe in you, but if things go south, it’s gonna cost us.” And in Franklin’s case, things did go south, and the cost is now in the spotlight.

According to reports, the daily cost of the James Franklin buyout is significant. But the real question is: Why is it structured this way? Well, universities want to attract top-tier coaching talent. Offering a lucrative, long-term contract with a substantial buyout clause is a way to signal commitment and security. It’s a way of saying, “We’re serious about winning, and we’re serious about having you lead us.” But as Penn State is discovering, these deals can come with a hefty price tag.

Why This Matters Beyond Football

So, why should someone in India care about the Penn State football program and its coaching contracts? Because it’s a microcosm of larger economic principles. This situation highlights the importance of carefully considering the long-term implications of any significant financial agreement. It underscores the power dynamics that can exist in contract negotiations, and it shines a light on the often-unseen financial aspects of high-profile sports.

What fascinates me is the ripple effect. A massive buyout can impact everything from athletic department budgets to ticket prices for fans. It forces universities to make tough decisions about resource allocation. Are they investing in player development? Academic support? Or are they primarily funding coaching salaries and potential buyouts? These are critical questions with no easy answers.

The Impact on Penn State and College Athletics

The sheer size of the James Franklin’s contract and subsequent buyout raises questions about the sustainability of current college athletics spending. We are looking at a situation where the university might face budget cuts in other sectors to accommodate these high costs. Could it affect scholarships? Facilities upgrades? The academic programs that support athletes? These are all possibilities.

But, there’s another angle to consider. A big payout might free Penn State to invest in other talented staff, whether they be football coaches or in other athletic departments. It’s a reset button of sorts, allowing the university to strategically re-invest in other areas of need. Let’s be frank, though — it’s a costly reset. Here’s an internal link to check out to other sports news.

Financial Implications of Coaching Changes

One thing that isn’t often talked about is the emotional toll on the fans and the players. A coaching change, especially one involving a significant buyout, can create uncertainty and anxiety. Players may question their future with the program. Recruits may reconsider their commitment. Fans may lose faith in the direction of the team.

Universities need to manage these situations with transparency and empathy. Clear communication is key to maintaining morale and trust. It’s not just about the money; it’s about the human element. And as per NCAA regulations , athletic programs need to maintain integrity and be responsible with their finances.

Navigating the Future | Lessons Learned

So, what can we learn from the Penn State-James Franklin situation? Firstly, universities need to be more diligent in negotiating coaching contracts. They need to carefully consider the potential costs and benefits of long-term deals with significant buyout clauses. Secondly, they need to be transparent with their stakeholders about the financial implications of these contracts.

Ultimately, this is a cautionary tale about the intersection of sports, business, and public accountability. It’s a reminder that even the most successful programs can face financial challenges, and that sound financial management is essential for long-term sustainability. What fascinates me the most? It is the long term financial health of an athletic program during these times. And don’t forget to check out the other internal link here .

FAQ About College Football Buyouts

Frequently Asked Questions

What exactly is a coach buyout?

A coach buyout is the amount a university pays a coach to terminate their contract early.

Why do universities offer such large buyouts?

To attract top coaching talent and signal a commitment to success.

How does a buyout affect the university’s budget?

It can strain the budget, potentially affecting other athletic programs or academic initiatives.

Are buyouts common in college football?

Yes, they are increasingly common, especially for high-profile coaches.

Who ultimately pays for these buyouts?

Often, it’s a combination of athletic department revenue, donations, and sometimes even university funds.

Is there any way to avoid these massive payouts?

Careful contract negotiation and performance-based incentives can help mitigate the risk.

In conclusion, the Penn State James Franklin contract extension buyout situation is a complex issue with far-reaching implications. It’s a reminder that even in the high-stakes world of college football, financial prudence and transparency are essential.