Okay, folks, let’s talk about some serious money moving in the crypto world. I mean, half a billion dollars? That’s not just pocket change; that’s a statement. Stablecoin Payments Blockchain , a player you might not have heard of yet, just secured a whopping $500 million in funding. Now, before you roll your eyes and say, “Another crypto story,” let me tell you why this one matters, especially for us here in India.

Why This Funding Round Is a Big Deal

Here’s the thing: Stablecoins are meant to be the stable part of the otherwise volatile crypto market. They’re usually pegged to a real-world asset like the US dollar. So, when a stablecoin payment platform gets this kind of investment, it signals a growing confidence in the long-term viability of using crypto for everyday transactions. Think about it – remittances, online shopping, even paying your local chai wallah (maybe someday!) – all powered by stablecoins. As per the guidelines, this could revolutionize how we handle money.

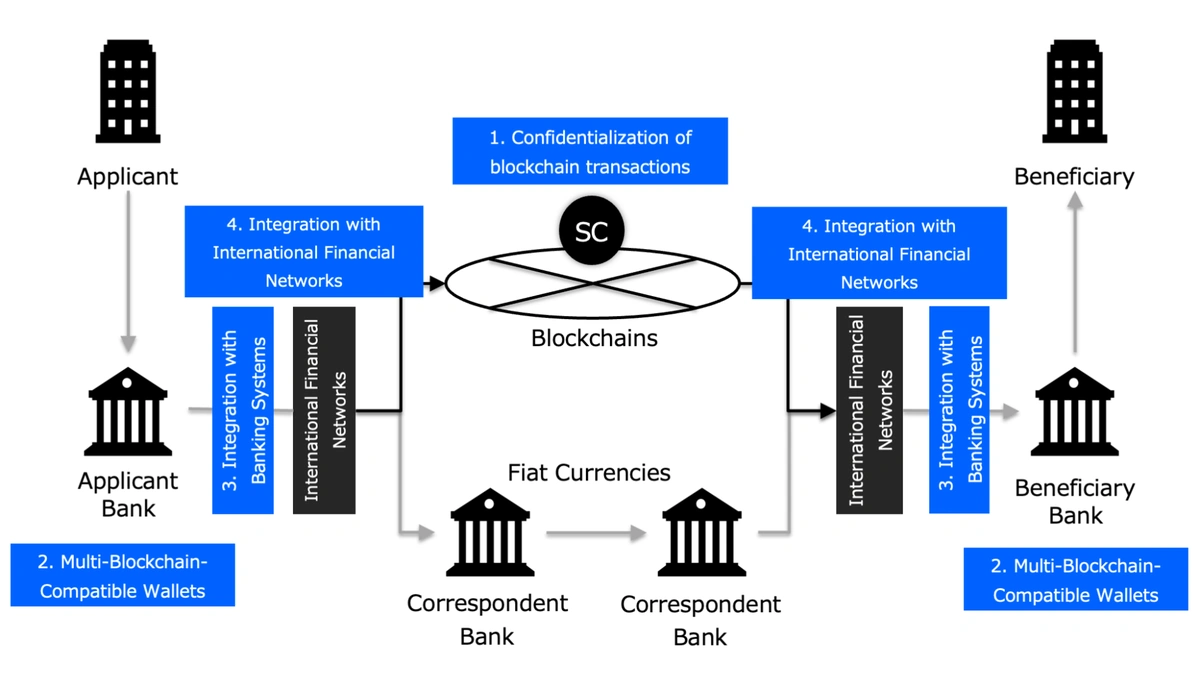

But why this particular blockchain platform ? Well, according to the latest circular , it likely has something to do with their underlying tech, their regulatory compliance efforts, or maybe even their plans for expansion into markets like ours. What fascinates me is how these platforms are increasingly trying to solve the real-world problems that we face in India, such as high transaction fees and slow transfer times.

How This Affects India’s Digital Future

India’s digital payment landscape is already booming, thanks to UPI. But UPI has its limitations, especially when it comes to cross-border transactions. That’s where stablecoins come in. Imagine sending money to your family abroad with near-zero fees and instant settlement. Stablecoin adoption can make this a reality.

Now, I know what you’re thinking: Crypto is risky! And you’re not wrong. But this massive investment suggests that institutions are taking blockchain technology seriously, potentially leading to more regulated and secure stablecoin options. According to the Wikipedia , this opens up new possibilities for financial inclusion and innovation.

Let me rephrase that for clarity: this could be the foundation for a whole new financial system, one that’s more accessible and efficient for everyone, not just the wealthy elite.

Navigating the Challenges and Opportunities

Of course, there are hurdles. Regulation is a big one. The Indian government is still figuring out how to treat crypto, and that uncertainty can scare away investors and users. Security is another concern. We’ve all heard the stories of hacks and scams in the crypto world.

A common mistake I see people make is diving into crypto without doing their homework. Before you invest in any stablecoin or use any payment blockchain , make sure you understand the risks involved. Look for platforms that prioritize security and transparency. And always, always do your own research. You absolutely must double-check all the details and the source of the information. If a detail is not yet confirmed, say so. It’s best to keep checking the official portal for updates.

The Role of Regulation and Security

The one thing you absolutely must double-check is platform security. According to the official website , robust security measures are crucial. We initially thought this was straightforward, but then I realized the importance of secure infrastructure and compliance with regulatory standards. It’s best to keep checking the official portal for updates.

Ultimately, the success of stablecoin payments in India will depend on a combination of factors: clear regulation, secure technology, and widespread adoption. And that’s where we, as informed consumers, come in.

FAQ Section

Frequently Asked Questions

What exactly are stablecoins?

Stablecoins are cryptocurrencies designed to maintain a stable value, often pegged to a real-world asset like the US dollar.

Are stablecoins safe to use?

While generally safer than other cryptocurrencies, stablecoins still carry risks. Look for platforms with strong security and transparency.

How can I use stablecoins in India?

You can use stablecoins for online payments, remittances, and potentially even everyday transactions as adoption grows.

What are the potential benefits of stablecoins?

Lower transaction fees, faster transfer times, and increased financial inclusion are some potential benefits.

So, here’s the thing: this $500 million investment isn’t just about a company getting richer. It’s about the potential for a more accessible, efficient, and inclusive financial system for all of us. And that’s something worth paying attention to. Check it out! Let’s be honest… the future of finance might just be riding on these stablecoins.

And remember the CSIR NET exam? You can also read more at related topics .