Buying a new car is one of the most exciting milestones in life. Whether you’re looking at the attractive Kia K5, the family-friendly Telluride or the innovative EV6, the journey from the showroom floor to your driveway involves one important step: finding the money. This is where Kia Finance comes in.

Navigating the world of car loans and leasing can often feel like wandering through a maze of jargon and numbers. But understanding your options doesn’t have to be a headache. In this guide, we’ll detail everything you need to know about Kia’s finance arm, how to secure the best rates and why millions of drivers rely on this service to get them behind the wheel.

What exactly is Kia Finance?

At its core, Kia Finance is the captive lending arm of the Kia brand. Its primary mission is to offer tailored financing solutions to customers looking to buy or lease a vehicle. By working directly with the manufacturer, this service can often offer competitive rates and special incentives that traditional banks cannot easily match.

When you sit down at the dealership, it’s likely the person in the finance office will connect you to Kia Motor Finance, a system often discussed alongside Best Remote Finance Jobs in the industry. This network acts as the backbone of the brand’s sales strategy, ensuring a path to ownership for buyers with varying credit profiles, while Kia Finance America manages accounts and customer support across the US market.

The Benefits of Choosing Kia Finance for Your Next Vehicle

Exclusive Manufacturer Incentives

The biggest draw with Kia Finance is access to “subsidized” prices. These are special interest rates sometimes as low as 0% or 0.9% offered directly by the manufacturer to move certain models. You usually won’t find these extremely low rates at a third-party bank because these banks have no vested interest in selling Kia cars.

Streamlined experience

One-stop shopping provides a degree of convenience. When you use Kia Finance, your credit application, vehicle registration and insurance verification are handled in one place. In addition, Kia Motor Finance offers an intuitive digital interface where you can manage your payments, view your bank statements and track the progress of your payments right from your smartphone.

Flexible terms

Whether you want a short 24-month loan to get paid quickly or a 72-month loan to keep your monthly payments low, the flexibility on offer is extensive. Kia Finance America works with a wide network of dealers to ensure that the terms of your contract fit your personal budget and lifestyle.

Leasing vs. Financing through Kia Finance

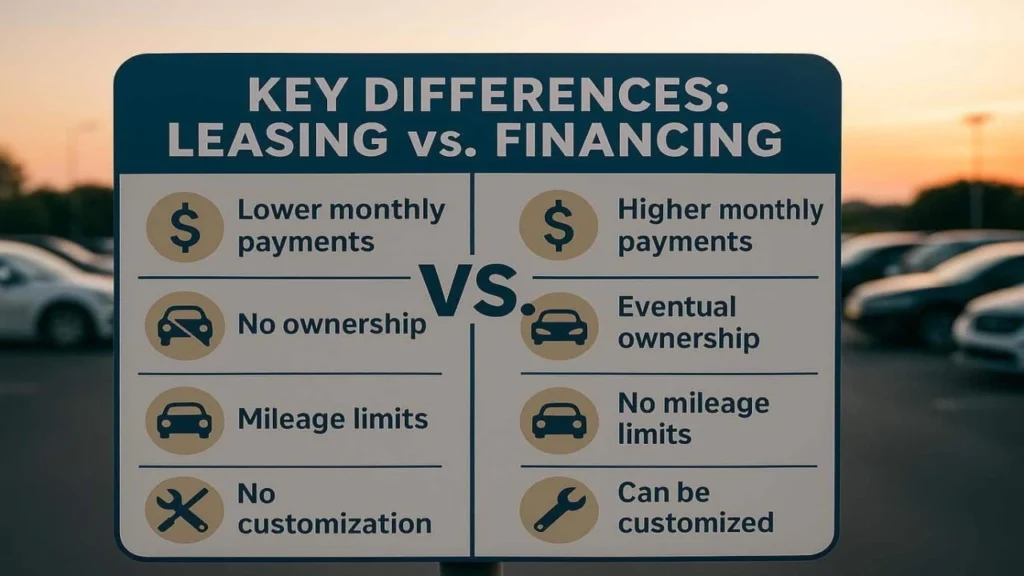

One of the most common questions buyers face is whether to lease or buy. Both routes are supported by Kia Finance, but they meet very different needs.

Financing (buying)

When you choose finance, you are taking out a loan for the full purchase price of the vehicle (minus your down payment and trade-in), making it one of the Best Auto Loans options for long-term ownership. Once the final payment is made, the car is yours, which suits drivers who log high mileage or plan to keep their vehicle for years, and Kia Motor Finance often offers competitive APRs to keep costs affordable.

Leasing

Leasing is essentially “renting” a car for a fixed period of time, usually two to three years. You only pay for the depreciation that occurs during that period. This results in significantly lower monthly payments. At the end of the term, you’ll return the car to Kia Finance America and can choose to lease a new model. It’s perfect for those who like the latest technology and security features every few years.

Understand the role of Kia Finance America

For drivers in the US, Kia Finance America is the entity you will interact with the most. They handle everything from the initial credit approval to the final “thank you” note when your loan is repaid. Their online portal is designed with the user in mind, allowing you to set up autopay, which is a great way to ensure you never miss a payment and helps protect your credit score.

In addition, Kia Finance America often runs regional promotions. Depending on where you live, from the snowy roads of Maine to the sunny coast of California, there may be specific “lease offers” or “cash back” offers unique to your local market.

How to prepare for your Kia finance application

If you want the best possible deal, don’t go into the dealership unprepared. Here’s how you can prepare for success when applying through Kia Finance.

Check your credit score

Your credit score is the most important factor in determining your interest rate. Kia Motor Finance uses your credit report to determine how ‘at risk’ you are. If your score is above 700, you will likely qualify for the most attractive promotional prizes. If it is low, you may still be approved, but the interest rate may be higher.

Save for the down payment

While “zero down” deals exist, you reduce the total amount you need to borrow by putting money down upfront. This not only lowers your monthly payment, but also reduces the amount of interest you pay over the term of the loan. Kia finance experts often suggest a down payment of 10% to 20% if possible.

Get pre-approval

Did you know that you can apply for credit on Kia’s website before you even enter the showroom? By getting pre-approved by Kia Finance America, you know exactly how much you can spend. This puts you in a stronger negotiating position and saves you from waiting for hours at the dealer.

Special programs presented by Kia Finance

One of the things that sets this brand apart is its commitment to specific communities. Kia Finance offers several special programs designed to give back and make car ownership more accessible.

- College Graduate Program: Graduates often have trouble getting a car loan due to a lack of credit history. Kia Motor Finance offers a special incentive (typically a $400 – $500 rebate) to help those who have graduated within the last two years.

- Military Specialty Incentive Program: As a thank you to the brave men and women of the armed forces, Kia Finance America offers a special discount to active duty, reserve and retired military personnel.

- Loyalty program: If you already own a Kia, you may be eligible for a “loyalty discount” when you trade in your old Kia for a new one through Kia Finance.

Frequently Asked Questions (FAQ)

1. How do I contact Kia Finance?

To contact Kia Finance, call their customer service line at 1-866-331-5632 for assistance with your account or payment.You can also reach them by email or contact form through the official Kia Finance website for support or inquiries.

2. Who is the finance company for Kia?

Kia’s finance division is Kia Motors Finance (sometimes called Kia Finance America), the official auto loan division that offers loan and lease options for Kia vehicles.

3. Who is Kia Finance owned by?

Kia Finance (officially Kia Finance America or Kia Motors Finance) is owned and operated by Hyundai Capital America, the captive auto finance arm of Hyundai Motor Group that provides financing and leasing for Hyundai, Genesis and Kia vehicles.

4. Is Kia better or Toyota?

Both Toyota and Kia have strengths, so neither is “better” than all others – it depends on your preferences.

5. Which is better Kia Seltos or Toyota Hyryder?

Seltos might be better if you want performance and features, while Hyderabadi is a good choice if you value fuel economy and reliability.