Let’s be honest, talking about money can feel like stepping into a financial jungle. It’s dense, confusing, and sometimes, frankly, a little scary. You’ve got bills, savings goals, maybe some debt lurking, and the constant question: “Where did all my money go?” Sound familiar? I get it. For years, I watched my finances with a mix of dread and denial. It wasn’t until I stumbled into the world of money management apps that I truly started to feel like I had a compass in that jungle.

Here’s the thing: managing your finances isn’t about being a math wizard or a Wall Street guru. It’s about clarity, consistency, and having the right tools. And in our hyper-connected age, those tools are often sitting right in your pocket. We’re talking about sophisticated software that goes far beyond a simple spreadsheet, transforming the daunting task of financial oversight into something manageable, even dare I say empowering. But it’s not just about downloading an app; it’s about understanding how to use it to truly change your financial trajectory, and why that change is more accessible now than ever before.

Why Your Wallet Needs a Digital Refresh | The Power of Money Management Apps

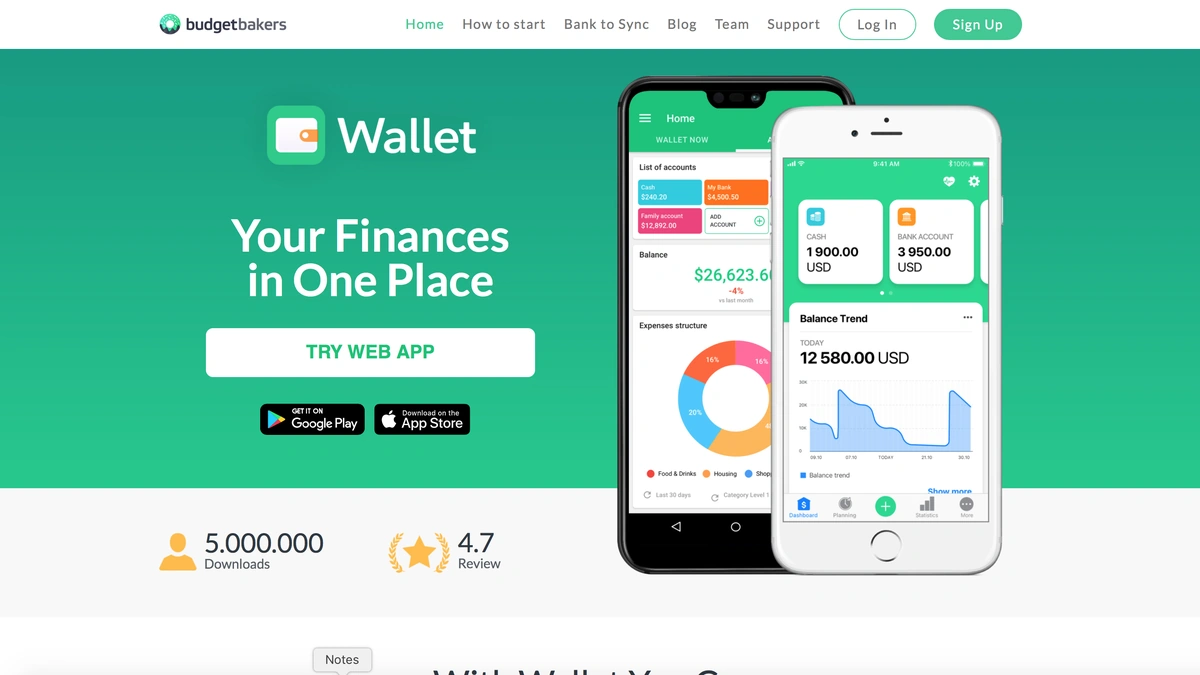

You might be thinking, “Do I really need another app on my phone?” And for some, the idea of linking their bank accounts to a third-party service still raises an eyebrow. I understand that hesitation. But let me rephrase that for clarity: these aren’t just glorified calculators. Modern money management apps are your personal financial strategists, your diligent accountants, and your encouraging coaches, all rolled into one. They offer an unparalleled view into your financial ecosystem, revealing patterns you might never have noticed before.

Think about it: how often do you check your bank balance and scratch your head, wondering why it’s lower than you expected? These apps connect directly to your accounts, automatically categorizing transactions. This means you can see, at a glance, exactly how much you spent on dining out last month, or how much those daily coffee runs are truly adding up. This granular insight is the first, crucial step toward taking control. Without knowing where your money is actually going, every attempt at budgeting is just a shot in the dark. It’s the ‘why’ behind the ‘what’ – why you’re overspending, why you’re not saving enough, and why you feel stressed about money.

Beyond simple tracking, these apps are fantastic budgeting tools. They allow you to set limits for different spending categories and alert you when you’re getting close to exceeding them. This proactive approach helps you course-correct before you’re in a bind. It’s like having a friendly reminder telling you, “Hey, maybe skip that extra online purchase today; you’re close to your entertainment budget!” This isn’t about deprivation; it’s about informed choices that align with your financial goals.

Picking Your Financial Wingman | Navigating the World of Personal Finance Software

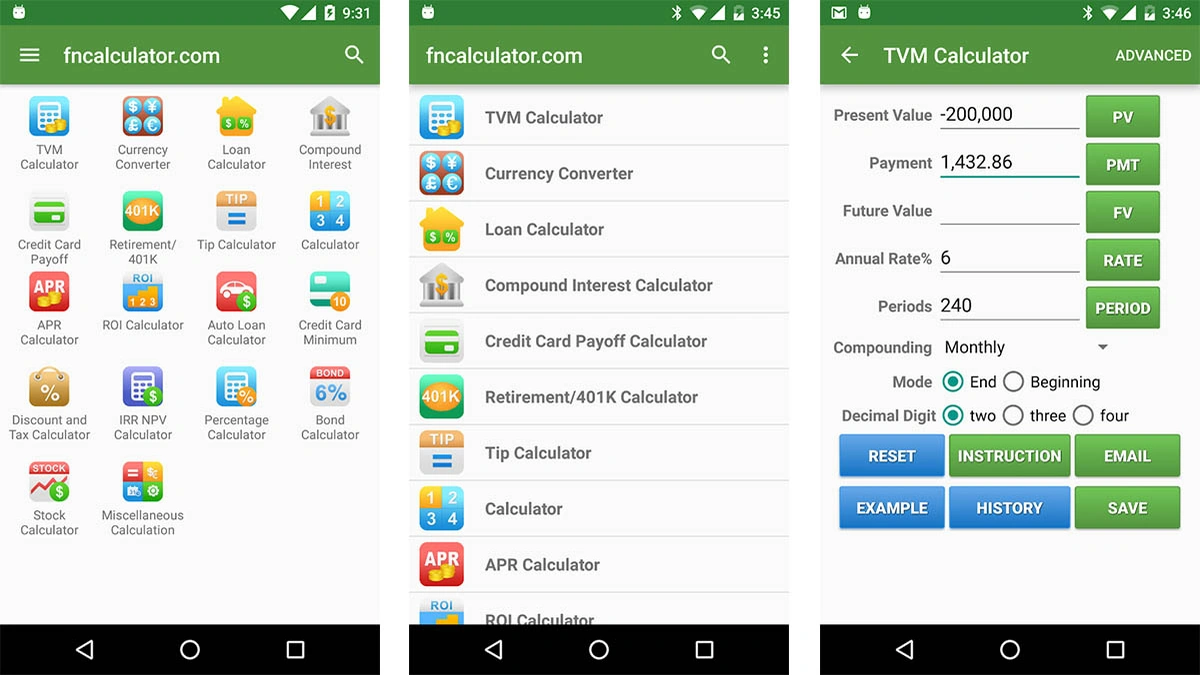

Okay, so you’re convinced. Now what? The market is flooded with personal finance software, each promising to be your ultimate financial savior. How do you choose the right one? It’s less about finding the “best” app and more about finding the “best for you” app. Just like you wouldn’t buy a car without test-driving it, you shouldn’t commit to a money management app without understanding its core features and how they align with your specific needs.

Do you need robust expense trackers that meticulously log every penny? Or are you more focused on big-picture financial planning, perhaps even dipping your toes into investments? Some apps excel at basic budgeting and bill management, while others offer advanced features like net worth tracking, investment analysis, and even debt payoff strategies. I always recommend starting with what you need right now. If it’s just getting a handle on your spending, a simpler, more intuitive app might be perfect. If you’re managing multiple accounts, investments, and complex financial goals, you’ll want something more comprehensive.

Consider the user interface. Is it clean, easy to navigate, and visually appealing? A clunky or confusing app will quickly become another unused icon on your phone. Also, security is paramount. Ensure the app uses bank-level encryption and offers multi-factor authentication. While no system is 100% hacker-proof, reputable apps invest heavily in protecting your data. Read reviews, check out their privacy policies, and maybe even try a free trial if available. The beauty is, you’re not locked in. If an app isn’t working for you after a few weeks, you can always explore alternatives.

Beyond the Basics | Leveraging Apps for Saving and Financial Planning

Once you’ve got a handle on your everyday spending, the real magic of money management apps begins to unfold. This is where they transition from mere record-keepers to powerful accelerators for your financial goals. Many apps offer dedicated features designed to boost your savings and streamline your long-term financial planning.

Take saving money apps, for instance. Some of these apps use clever algorithms to analyze your spending habits and automatically round up your purchases to the nearest dollar, then sweep that change into a savings account. Others allow you to set specific savings goals a down payment, a vacation, an emergency fund and then help you visualize your progress and set up recurring transfers. It’s a psychological trick, really: making saving feel less like a chore and more like an effortless background process. What fascinates me is how these small, consistent actions, facilitated by an app, compound into significant sums over time.

For those looking further ahead, robust apps often incorporate features for holistic financial planning apps. This can include tracking investments, monitoring retirement accounts, and even modeling different financial scenarios. Imagine being able to see how an extra $100 saved per month could impact your retirement date! This isn’t just about crunching numbers; it’s about gaining clarity and confidence in your financial future. It removes the guesswork and replaces it with data-driven insights, empowering you to make more informed decisions about everything from large purchases to career changes.

Tackling Debt and Tracking Progress | Real-World Impact

One of the most profound impacts of adopting money management apps is their utility in debt management. For many, debt feels like a crushing weight, an insurmountable mountain. But these apps provide the tools to chip away at it, piece by piece. They can help you visualize your total debt, calculate interest, and even suggest strategies like the “debt snowball” or “debt avalanche” methods, allowing you to see which approach will save you the most money or get you debt-free fastest.

By helping you to clearly track spending, these apps indirectly free up cash flow that can then be directed towards debt repayment. When you know exactly where every dollar is going, you can identify areas to cut back and reallocate those funds more strategically. I’ve seen countless people transform their financial lives by first using these apps to stop the bleeding of unnecessary expenses, and then channeling that saved money directly into accelerating their debt payoff. It’s not just about the numbers; it’s about the emotional relief and freedom that comes with seeing that mountain shrink.

Moreover, the visual dashboards and progress reports offered by these apps are incredibly motivating. Seeing your net worth slowly climb, your savings accounts grow, and your debt balances dwindle can be a powerful psychological boost. It reinforces positive financial habits and keeps you engaged with your goals, turning what used to be a tedious chore into an encouraging journey. It’s like watching your health metrics improve on a fitness tracker – that immediate feedback keeps you going.

My Two Cents | Making Money Management Apps Work for You

So, where do you go from here? My biggest piece of advice is simple: start. Don’t wait until you feel like an expert. Choose an app that seems intuitive, link your accounts, and just begin. The first month might feel a little clunky as you get used to categorizing transactions or setting up budgets. But stick with it. Consistency is the real game-changer here.

Remember, a money management appis a tool, not a magic wand. It can provide unparalleled insights and automation, but it still requires your engagement. Regularly review your budgets, adjust your goals as life changes, and celebrate your small wins. Whether you’re aiming to save for a big purchase, pay down student loans, or simply gain peace of mind about your finances, these apps can be the powerful ally you need. They give you the data, the guidance, and most importantly, the control to navigate that financial jungle with confidence.

Frequently Asked Questions About Money Management Apps

What are money management apps?

Money management apps are digital tools that help you track spending, create budgets, and manage your overall finances on your mobile device.

Are money management apps secure?

Reputable money management apps use bank-level encryption and multi-factor authentication to protect your financial data.

How do money management apps help with budgeting?

They automatically categorize transactions, allow you to set spending limits, and alert you if you’re close to exceeding your budget categories.

Can these apps help me save money?

Absolutely! Many include features for setting savings goals, rounding up purchases, and automating transfers to savings accounts.

What’s the best money management app for beginners?

The “best” depends on your needs, but many recommend apps with intuitive interfaces for basic expense tracking and budgeting features.